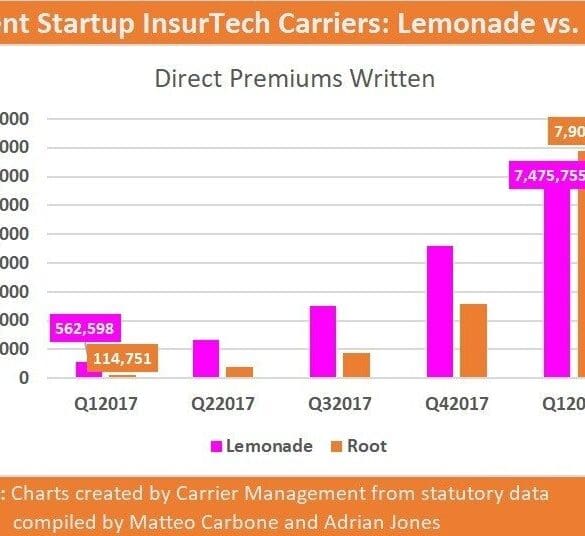

Insurtech startup Lemonade raised $120mn led by Softbank with backing from Allianz, Sequoia Capital and Google Ventures; the company has licenses in 25 states across the US and has sold more than 80,000 policies since launch last year; “By combining big data and AI with a seamless user experience, Lemonade is truly revolutionizing the insurance industry,” said David Thevenon, a senior investment professional at SoftBank, to the Financial Times. Source.

Bloomberg discusses the inner workings of SoftBank’s fund which includes Apple and Saudi Arabia; many former Deutsche Bank AG traders work at the firm; it has invested in a broad range of companies and is currently the world’s largest private equity fund. Source

I've been seeing a lot of Fintech headlines recently that make me raise my hands in the air, and go "Come on, are you for real!?". I imagine a lot of people feel similarly frustrated by Lemonade looking to go public at a $2 billion valuation on $50 million of revenue, Initial Exchange Offerings on crypto exchanges raising over $500 million this year, Facebook's tone deaf Silicon Valley club crypto money, or SoftBank talking about selling its overpriced $100 billion Fintech unicorn fund in an IPO. So other than getting crankier with age (Happy Father's day everyone!), I want to dig a little bit into the concept of fairness, asymmetric information, economic rents, and how this can help disentangle feelings from thoughts on these news items.

Last year SoftBank agreed to make a €900mn investment into Wirecard; as part of the deal they were going to...

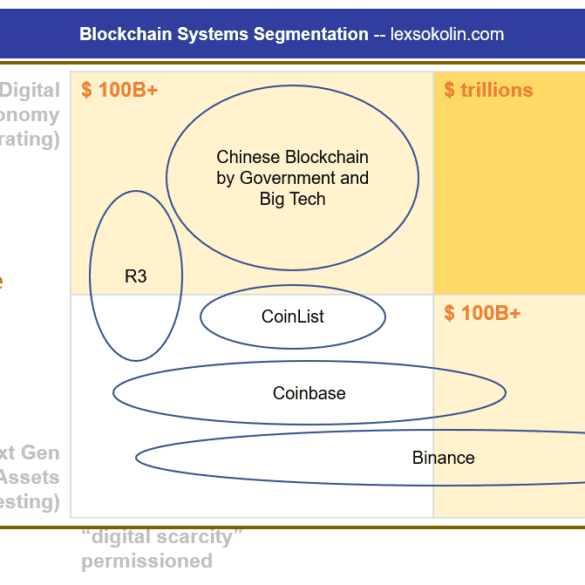

Blockchain progress through the lens of Binance’s $180MM profit and Greensill’s $1.5B SoftBank raise

Look at the difference between (1) building out the crypto asset class, and (2) operating infrastruture for a blockchain-based digital economy. There are so many little logic pot holes into which you could fall! There are so many things one could believe that make the whole thing make no sense at all! I am anchoring around two primary data points -- a Multicoin report about Binance's financial progress and its massive (though unaudited) $180 million profit in Q3 of 2019, and a post by supply chain company Centrifuge about marrying cashflow financing with the decentralized web.

Another heavy week. It is hard to find the right, or even the interesting, thing to say. I look at why the $2 trillion in US bailouts may not even be enough to stave off the economic damage. In particular, I am alarmed by the large and fast rise of unemployment claims (higher than 2008 peak), estimates that GDP may fall by 20-30%, and the broad impact on small business. Small businesses have 27 days of cash on hand, and power half of our economies through both employment and output. So how do we meet this challenge? What strength should we draw on in the moment of doubt to become the artists of tomorrow?

Earlier this year SoftBank Group invested $20 million into the Mexican payments startup called Clip, marking one of their first...

SoftBank’s Vision Fund is planning to invest in the British banking startup according to sources; if it goes through it...

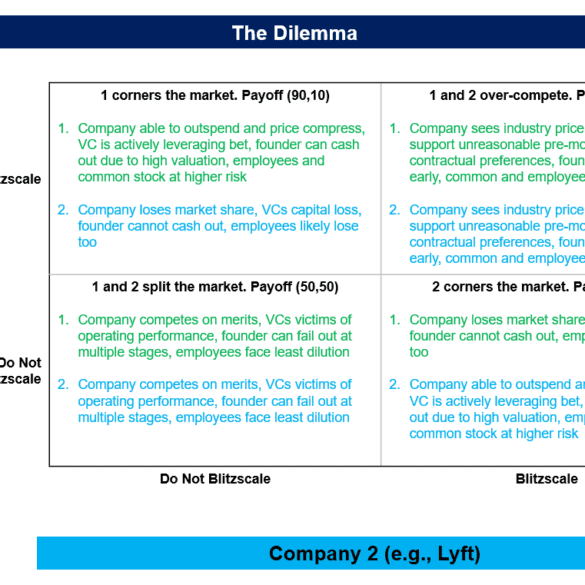

Why are high valuations bad? You've heard me talk about how the trend of Fintech bundling, and the unicorn and decacorn valuations led by SoftBank and DST Global, are creating underlying weakness in the private Fintech markets. Of course, they are also creating price compression and consolidation in the public markets (e.g, Schwab/TD, Fiserv/First Data) across sub-sectors. But public companies are at least transparent and deeply analyzed. Private companies have beautiful websites, charismatic leaders, and impressive sounding investors. Often when you look under the hood, it's just a bunch of angry bees trying to find something to sting.

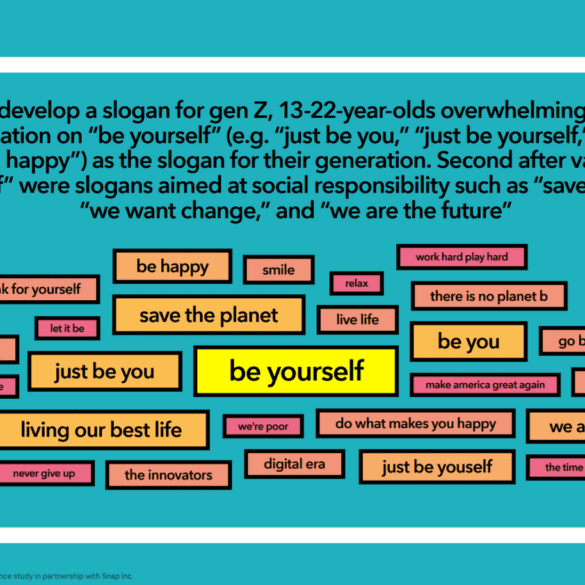

Gen Z is becoming a cultural force, reshaping culture and online society. This is starting to echo in fintech startups and crypto protocols. We explore how financial communities are beginning to congeal into DAOs, their nature and structure, and potential longer terms outcomes. The analysis identifies the differences in Millennial and Gen Z approaches — however imperfectly — to explain the frontier of social tokens and why ShapeShift chose decentralization, while Revolut chose decacorn funding.

DAOs are not socialist communes built for the benefit of humankind. Rather, they are techno-fortresses to defend, and make valuable, exclusive online tribes.

Whereas Millennials dream about a VC-funded unicorn startup, permissioned into wealth with capital from traditionally successful investors, Gen Z and crypto natives dream about bottoms-up community syndicates with trillions to spend on the sci-fi future, unshackled from regulatory overhang and the sins of the 2008 quantitative-easing past.