SBI Group, owner of SoftBank is investing into the mobile-first bank; SBI Group will also get a seat on Moven's board and the companies plan to form a joint venture in Japan; Moven is also splitting its business in two; one side is the software provider that powers digital banking software and the other is the neobank, MovenBank; Moven also announced that it is in the process of purchasing a US bank. Source

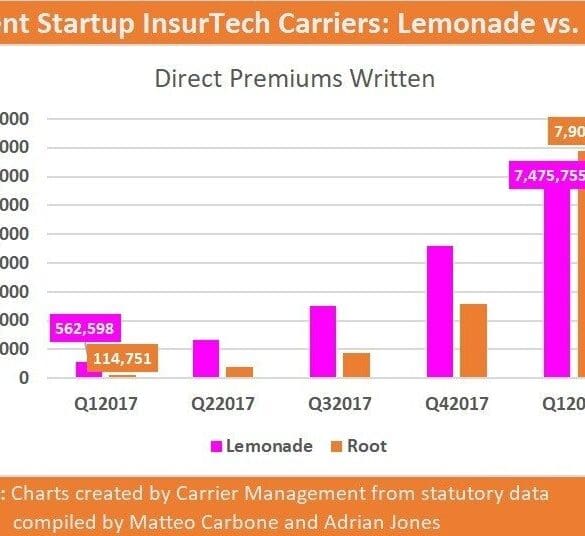

I've been seeing a lot of Fintech headlines recently that make me raise my hands in the air, and go "Come on, are you for real!?". I imagine a lot of people feel similarly frustrated by Lemonade looking to go public at a $2 billion valuation on $50 million of revenue, Initial Exchange Offerings on crypto exchanges raising over $500 million this year, Facebook's tone deaf Silicon Valley club crypto money, or SoftBank talking about selling its overpriced $100 billion Fintech unicorn fund in an IPO. So other than getting crankier with age (Happy Father's day everyone!), I want to dig a little bit into the concept of fairness, asymmetric information, economic rents, and how this can help disentangle feelings from thoughts on these news items.

The Brazilian digital lender added $200 million in its ninth funding round and announced it was buying both a bank and a mortgage lender.

Uber has entered finance! The end is nigh! The boogeyman is here!

Oh. So what's involved? There's a debit card and a "debit account" powered by Green Dot, the same bank that's behind Apple Pay's person to person service. That means that Uber isn't a bank, but is renting shelf space on one. There's a wallet that will be integrated into the Uber app, within the driver's experience. So tracking your earnings and spending will be a feature that is part of the app -- not unlike what Amazon has had for years for merchants. There is a credit component, letting drivers withdraw money against their payckeck. And there's a Barclays credit card, private labeled for Uber, riding on the VISA rails.

Hear ye, hear ye, beware the disruption and tremble under its glory!

Reuters is reporting that Softbank is in talks to invest in Nubank, the leading digital bank in Latin America; according...

Bloomberg discusses the inner workings of SoftBank’s fund which includes Apple and Saudi Arabia; many former Deutsche Bank AG traders work at the firm; it has invested in a broad range of companies and is currently the world’s largest private equity fund. Source

Insurtech leader Lemonade has filed to go public; the company is backed by an A-list group of venture capitalists including...

Accounting firm Ernst & Young failed to request bank statements from the Singapore bank that the fintech claimed to have...

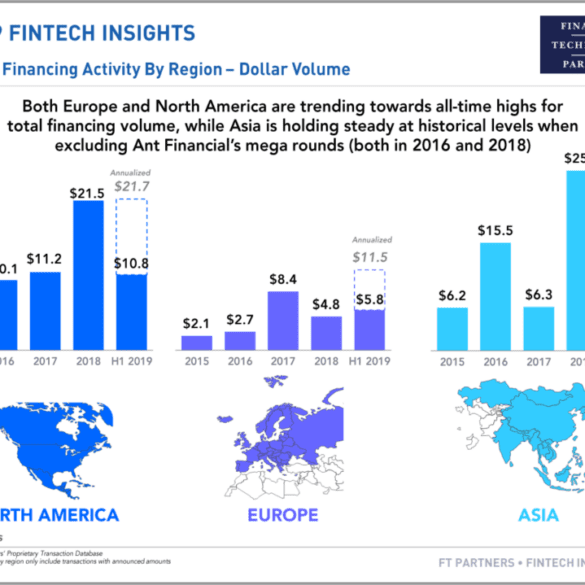

Fintech is expensive. Fintech is everywhere. If you are a thinking about starting a financial services company, and it does not have technology at its core -- don't. You will lose to someone similarly positioned building a more augmented business. Fintech is the global competition for regulation, talent, and macroeconomic supremacy. Fintech is the trade war between the US and China. Fintech is Facebook and Amazon. Fintech is the next bubble to burst. Fintech has burst already.

Creditas is a Brazilian fintech startup that is now valued at $700 million; the company was originally founded in 2012...