SoftBank is a telecommunications and internet focused business with its headquarters in Japan; the firm has announced it will be acquiring asset manager Fortress Investment Group for $3.3 billion; SoftBank owns and invests in a range of internet and digital businesses; the acquisition follows a previous collaboration between SoftBank and Fortress on a new $100 billion Vision Fund; Fortress will be run independently from SoftBank after the acquisition and will be led by existing Fortress principals Pete Briger, Wes Edens and Randy Nardone with close collaboration on the Vision Fund. Source

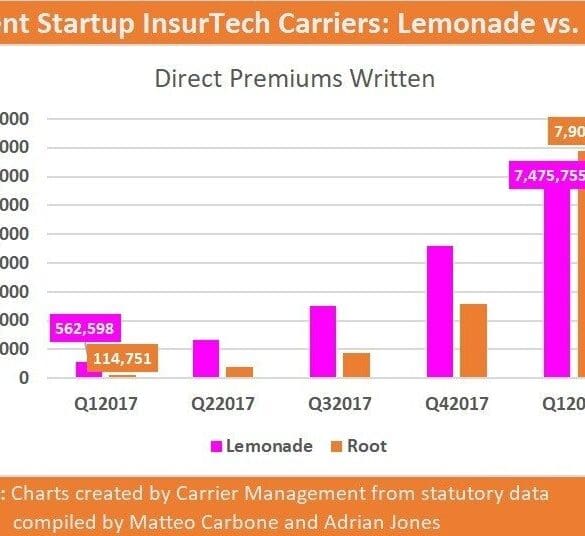

Insurtech startup Lemonade raised $120mn led by Softbank with backing from Allianz, Sequoia Capital and Google Ventures; the company has licenses in 25 states across the US and has sold more than 80,000 policies since launch last year; “By combining big data and AI with a seamless user experience, Lemonade is truly revolutionizing the insurance industry,” said David Thevenon, a senior investment professional at SoftBank, to the Financial Times. Source.

SoftBank’s Vision Fund is planning to invest in the British banking startup according to sources; if it goes through it...

Earlier this year SoftBank Group invested $20 million into the Mexican payments startup called Clip, marking one of their first...

Creditas is a Brazilian fintech startup that is now valued at $700 million; the company was originally founded in 2012...

Bloomberg discusses the inner workings of SoftBank’s fund which includes Apple and Saudi Arabia; many former Deutsche Bank AG traders work at the firm; it has invested in a broad range of companies and is currently the world’s largest private equity fund. Source

SBI Group, owner of SoftBank is investing into the mobile-first bank; SBI Group will also get a seat on Moven's board and the companies plan to form a joint venture in Japan; Moven is also splitting its business in two; one side is the software provider that powers digital banking software and the other is the neobank, MovenBank; Moven also announced that it is in the process of purchasing a US bank. Source

Despite recent challenges with accounting issues in its Asian arm German payments company Wirecard has received a $1 billion funding...

Reuters is reporting that Softbank is in talks to invest in Nubank, the leading digital bank in Latin America; according...

I've been seeing a lot of Fintech headlines recently that make me raise my hands in the air, and go "Come on, are you for real!?". I imagine a lot of people feel similarly frustrated by Lemonade looking to go public at a $2 billion valuation on $50 million of revenue, Initial Exchange Offerings on crypto exchanges raising over $500 million this year, Facebook's tone deaf Silicon Valley club crypto money, or SoftBank talking about selling its overpriced $100 billion Fintech unicorn fund in an IPO. So other than getting crankier with age (Happy Father's day everyone!), I want to dig a little bit into the concept of fairness, asymmetric information, economic rents, and how this can help disentangle feelings from thoughts on these news items.