Small business data is more plentiful now than ever before and tech tools are evolving to help fintech lenders meet the challenge.

LoanPro’s credit platform integration with Visa DPS helps brands tackle shrinking interchange fees while providing unique personalization.

Plaid has announced a new cash flow underwriting tool call Consumer Report that is the most comprehensive offering for lenders yet.

Hispanics are an emerging American economic force, and Tricolor founder and CEO Daniel Chu has a plan to serve them.

Exclusive interview with Andrew Seiz, head of finance at Kueski, on the 2024 outlook for consumer lending and Buy Now Pay Later in Mexico.

While both Generation Z and millennials are maturing during difficult financial times, TransUnion’s study Solving for Z shows Generation Z has it harder.

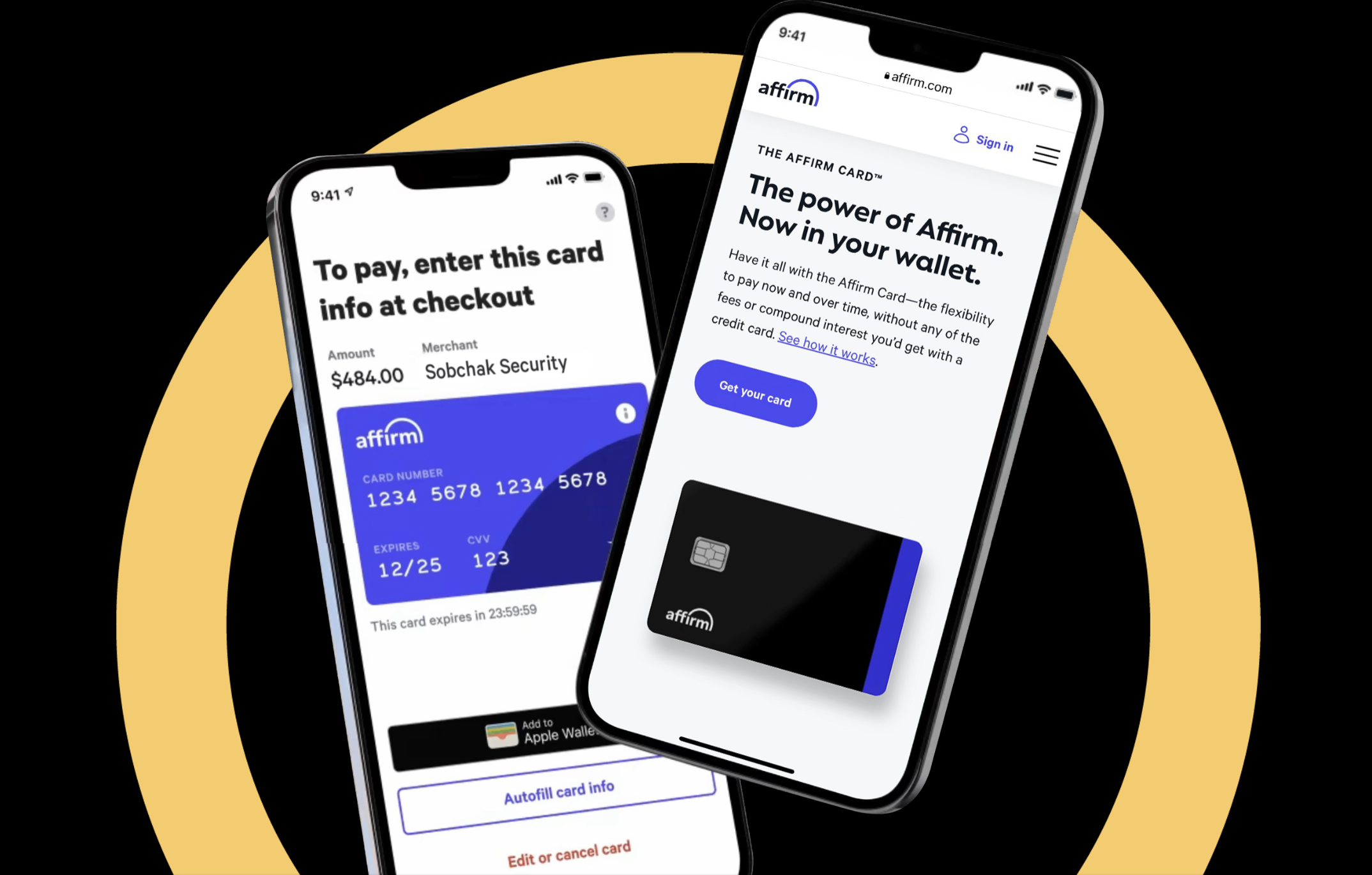

Affirm's earnings were fantastic. This continued the trend of publicly traded fintech companies breaking records for revenue and profitability.

As scrutiny of Buy Now Pay Later increases, so too do satisfaction scores among customers using the short-term financing mechanism structured like an installment loan.

Results of a new survey from PayNearMe show demand for digital payment types and general dissatisfaction with the loan-paying process.

Lending is going through a new wave of innovation and we want to hear what is most interesting and important to you.