Embedded finance is having a moment. While those of us in fintech marvel at all the technological innovation enabling its different facets, the reality is that embedded finance is helping people in very real ways.

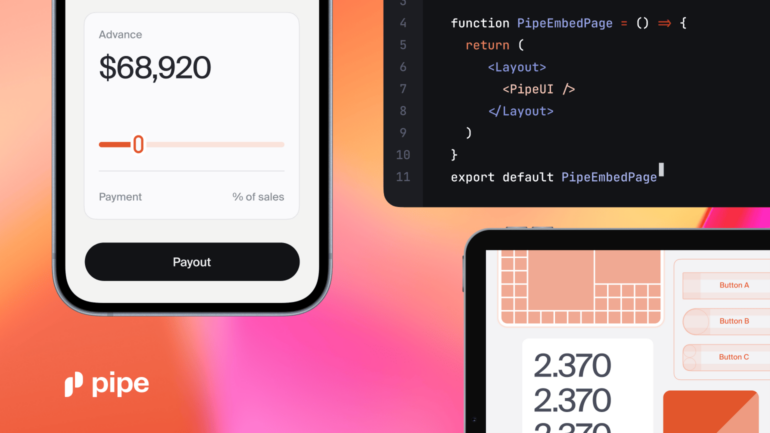

Pipe announced the launch of their Capital-as-a-Service (CaaS) offering this morning. This new development in embedded finance is going to have a dramatic impact on small businesses all over the country.

It pains me that after more than a decade in fintech, much of it focused on the lending space, we have still not solved the small business lending problem. Millions of small businesses still lack access to capital because lenders have not figured out a way to underwrite heterogeneous small businesses, often with owners who are thin-file or have bad credit. While, admittedly, fintech lenders have made a dent in this problem, it is still not solved.

Enter Pipe. It has been around for almost five years but has primarily focused on providing capital for SaaS companies. It has done quite well in this endeavor, raising hundreds of millions of dollars in venture capital and being one of the unicorns in the fintech space.

In November 2022, we learned that the founding team had all stepped down and a new CEO search had begun. They hired fintech veteran Luke Voiles, formerly of Square Banking and Intuit, where he focused on small business lending. For a detailed understanding of Luke’s approach, you should listen to my recent podcast interview with him.

Pivot to embedded finance

He has brought his learnings from Square and Intuit to Pipe and has pivoted the company away from a SaaS focus to this embedded finance offering. The fruit of this change is today’s announcement.

Pipe announced three companies as their launch partners here. Priority is a payments company looking to expand into lending, Infinicept is a payments facilitator that provides embedded payments, and Boulevard is a vertical software company focused on self-care small businesses.

Boulevard was so happy with the recent pilot they did with Pipe that they have already announced their new capital offering for their clients, which has been well received and has achieved very strong adoption early on.

The key is design and focusing on the user journey. Each Pipe client will have a very different user journey, which is why Pipe’s head of design is involved very early on in the process. You want to surface this capital offering at the point of need or at the place where the user visits regularly. Every step in the user journey needs to be considered to ensure success.

While each client will decide the parameters of their offerings, the average offer size is expected to be between $30,000 and $50,000, with payback periods ranging from six to 12 months.

Small businesses are eager for this kind of simplified capital access, with Pipe seeing some impressive numbers. According to Luke, “We’ve had pilots with 5% conversion rates and 95 NPS scores. The highest recommendation scores I’ve seen for something like this were maybe 82 or 83. Merchants just haven’t had this kind of experience getting capital before.”

How it works

Like most embedded finance offerings, this is a white-label product. Pipe’s clients will typically go to their clients with a capital offering featuring their own brand, as Boulevard did in their creation of Boulevard Capital.

Basically, Pipe’s clients can launch a new line of business without having to go to the time and expense of creating an entire lending division. All the underwriting, risk management, and complexity are removed as Pipe handles the process from end to end. They then share the economics of each transaction.

Speaking of which, we are not talking about installment loans here. These are advances that are paid back by small businesses as Pipe’s clients process customer payments. Think of them as a friendly version of merchant cash advances (MCA).

This is the key to the entire operation. Pipe inserts itself into the payments flow so they can ensure their clients are paid back whenever the end small business makes a sale. By doing it this way, the underwriting window opens dramatically.

Pipe is not interested in seeing three years of a small business’s bank statements or the owner’s credit score. They are focused on payment flows and advance against this future revenue. This is similar to the way Square Lending works, a business Luke was responsible for when he worked at Block.

Ability to scale

For Pipe, this model gives them the ability to scale that the SaaS-centric business never afforded. By signing on just one partner, they could potentially generate hundreds or even thousands of advances.

As software continues to eat the world, more small business owners are running their business with specialized software. As Luke pointed out in this article, vertical software companies could end up becoming the new community banks. And as that transition happens Pipe is poised to take advantage.

While embedded finance is a capital-intensive business, Pipe has enough capital to finance up to $1.2 billion a year in advances right now. As they scale, they will begin to do whole loan sales to ramp up their capacity even more. Luke expects they will start doing that sometime later this year.

If you are a small business owner with a thin file or no credit score, it has been very difficult for you to access affordable finance to grow your business. But today, there are now real options available to you and that is only going to increase as embedded finance becomes more widespread.

There has never been a better time to be a small business owner.