While the future of payments is digital, Gnosis Pay co-founder and CEO Marcos Nunes said that leaves plenty of room for consumer choice.

This week, Isabelle had Matt Homer back on the show to talk about the outlook for DeFi amidst this year's headwinds on the sector.

Wall Street backed EDX Markets launched two weeks ago making a critical shift in TradFi's approach to crypto. Will this change DeFi?

It must have been hard for those early Internet dot com founders to watch their ideas burn up like kindling. What was yesterday a song of genius and risk-taking became a caricature of hubris and bubbles. Pets.com, lol, they said.

Of course all the Internet people were right, just not at the right time. Being in the moment, you really can’t tell when the right time is. You might only be able to tell when it’s over, and the music ain’t playing no more.

It’s the roaring twenties, people say about the start of this decade. Like, that’s a good thing? Of course the 1920s ended with the Great Depression, a restructuring of the social order, and a political path to the worst war in human history. But you know, some people had fun in the stock market! Even Keynes — for all his economist words — lost his shirt. Only political power and the gun mattered in the end. It was Kafka who was right.

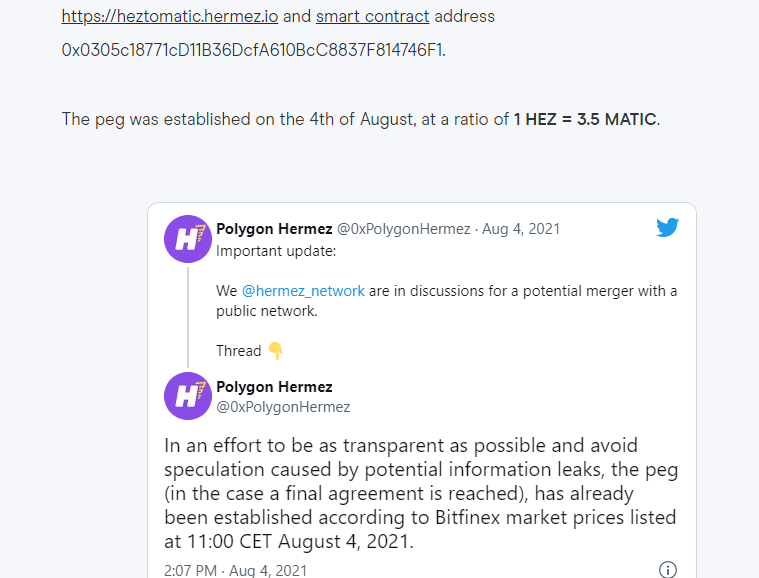

We look at the state of M&A in decentralized protocols, and the particular challenges and opportunities they present. Our analysis starts with Polygon, which has just spent $400 million on Mir, after committing $250 million to Hermez Network, in order to build out privacy and scalability technology. We then revisit several examples of acquisitions and mergers of various networks and business models, highlighting the strange problems that arise in combining corporations with tokens. We end with a few examples that seem more authentic, highlighting how they echo familiar legal rights, like tag alongs and drag alongs, from corporate law.

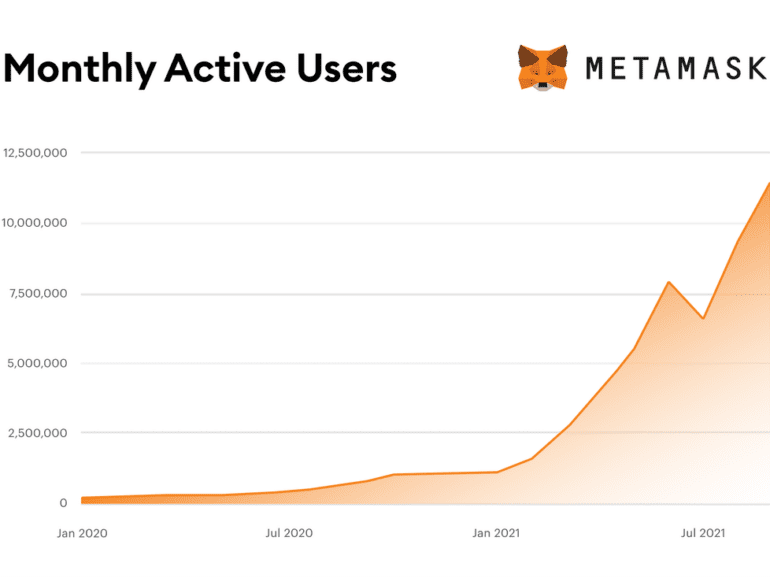

In this conversation, we chat with Daniel Finlay – a former Apple software developer, co-founder and co-lead developer on MetaMask – a non-custodial Ethereum wallet, allowing users to store Ether and other ERC-20 tokens and make transactions. Further. With the growth of DeFi and NFTs over the past year, MetaMask has increased in prominence as an entry point for novice users. So much so that its user base is now over 20 million monthly active users.

More specifically, we touch on how Dan went from teaching kids to code to having an app rejected by the Apple App Store to MetaMask, the philosophy behind e-government, questioning the role and job of software engineers, how crypto wallets compare to neobanks, and so so much more!

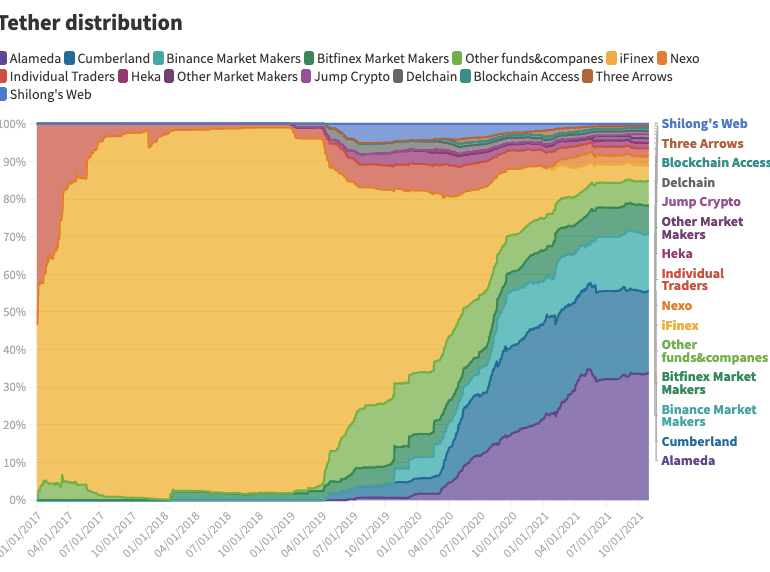

We look at a recent report from Protos that traces the issuance of USDT to the institutional players in the centralized crypto capital markets. The data reveals the market share of players like Alameda, Cumberland, Jump, and others in powering trading in exchanges. We try to contextualize this market structure with what exists both in (1) investment banking and (2) decentralized finance. The analogies are helpful to de-sensationalize the information and calculate some rough economics.

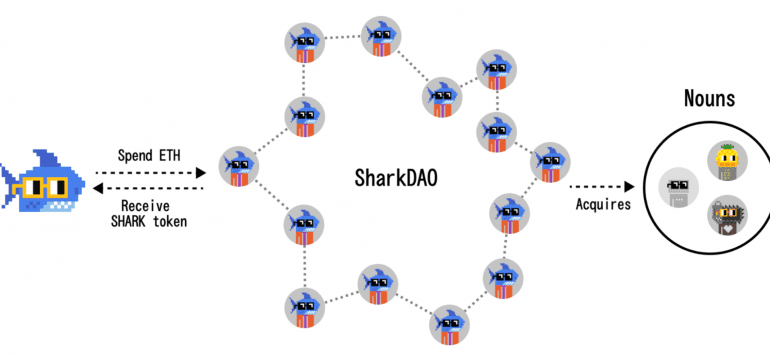

In this conversation, we chat with Nicholas – an NFT developer and a contributor to Juicebox, which is an awesome DAO enablement software, as well as SharkDAO and PartyDAO. He is very active in the ecosystems, got a solidity podcast called Solidity Galaxy Brain, a collaborator with multiple NFT artists, but I could go on and on. Let me welcome Nicholas to the podcast.

More specifically, we touch on the philosophy behind programming and coding, what a decentralized autonomous organization (DAO) truly is and what it is comprised of, various successful examples of DAOs that Nicholas has been involved in, the concept of community and the value that DAOs serve in this respect, how DAOs leverage tools to achieve their purpose, and so so much more!

We discuss the Facebook pivot into the metaverse and its rebrand into Meta. Our analysis touches on the competitive pressures faced by the company from big tech players, other ecosystem builders, and limits to growth for a $1 trillion business that likely motivated this refocus. We further dive into network effects around platforms, and why super apps and financial features are attractive, and how owning the hardware is a required defensive strategy. Lastly, we discuss these development through the crypto and Web3 lens, deeply disappointed with Facebook trying to domain park a generational opportunity with a centralized solution.

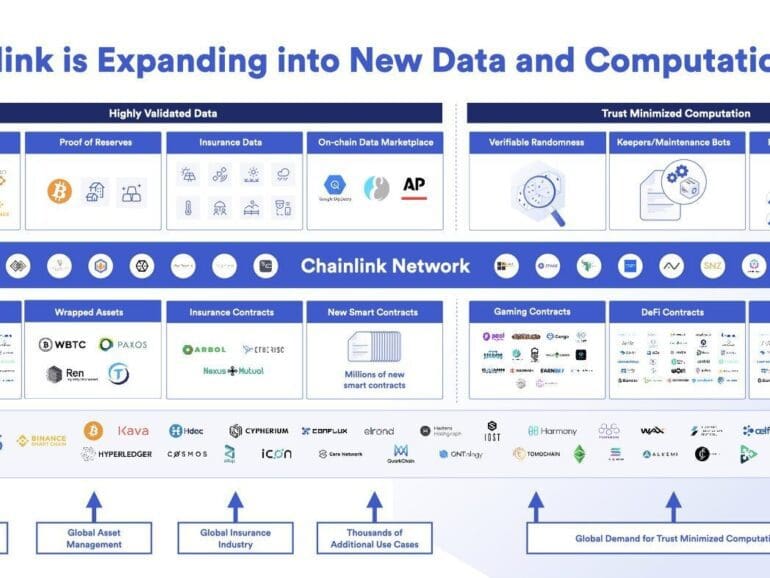

In this conversation, we chat with Sergey Nazarov. Sergey is Co-founder of Chainlink, the leading decentralized oracle network used by global enterprises & projects at the forefront of the blockchain space.

Chainlink is the industry standard oracle network for powering hybrid smart contracts. Chainlink Decentralized Oracle Networks provide developers with the largest collection of high-quality data sources and secure off-chain computations to expand the capabilities of smart contracts on any blockchain. Managed by a global, decentralized community, Chainlink currently secures billions of dollars in value for smart contracts across decentralized finance (DeFi), insurance, gaming, and other major industries.

More specifically, we touch on what it means to build in DeFi, what Oracles are like, what smart contracts are and what they enable, how all of this works and where the protocol is going, and so much more!