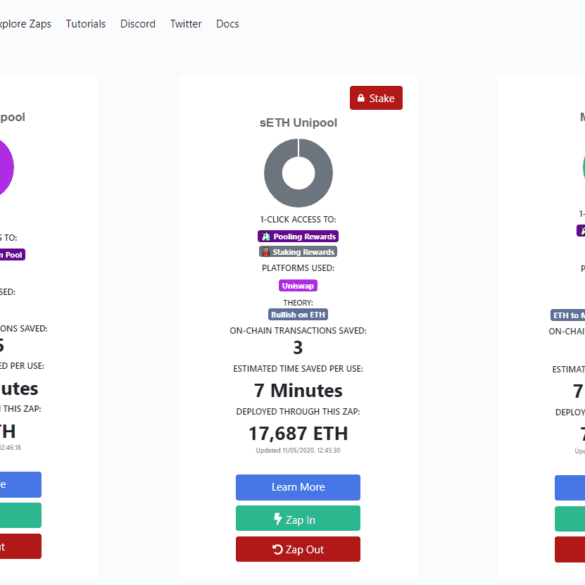

This week, I pause to reflect on the sales of (1) AdvisorEngine to Franklin Templeton and (2) the technology of Motif Investing to Schwab. Is all enterprise wealth tech destined to be acquired by financial incumbents? Has the roboadvisor innovation vector run dry? Not at all, I think. If anything, we are just getting started. Decentralized finance innovators like Zapper, Balancer, TokenSets, and PieDAO are re-imagining what wealth management looks like on Ethereum infrastructure. Their speed of iteration and deployment is both faster and cheaper, and I am more excited for the future of digital investing than ever before.

ICBA selects first fintechs for new accelerator program Partnerships, UX improvements and speed will drive money transfer in 2019 Brexit...

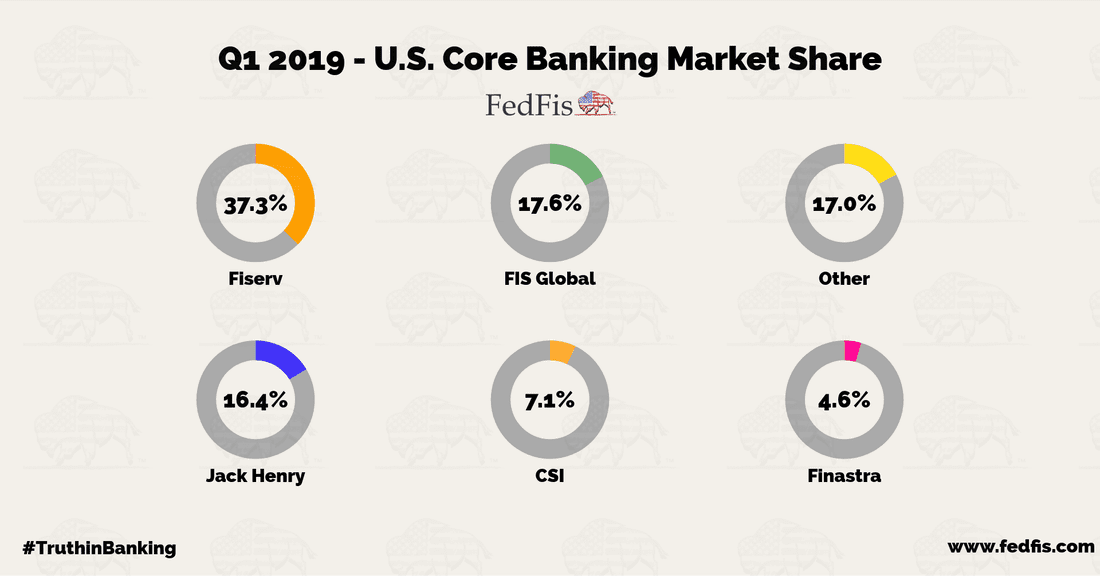

Back in 2013 four core banking providers dominated the U.S. market owning a 96 percent share, that market share is...

Fiserv‘s acquisition of First Data points to the power of fintech and the threat it poses to more traditional payments...

In an all-stock transaction of $22 billion, Fiserv has acquired First Data. The acquisition will allow Fiserv to now offer a...

Fiserv unveils new digital mortgage product, giving credit unions a leg up With the $3 billion alternative data industry exploding,...

Back in 2013 four core banking providers dominated the U.S. market owning a 96 percent share, that market share is...

The core banking provider market is starting to feel the winds of change as banks start seeking newer providers and...

Fiserv saw $3.7bn in revenue for Q4 2019 with First Data accounting for 61 percent of that total or $2.2bn;...

US fintech giant Fiserv acquired Argentine digital wallet Yacare to ramp up its offering to clients and compete with Mercado Libre.