Fiserv partnered with TransUnion to use their CreditVision Link software to help asses risk in their auto loan origination system; Fiserv is specifically looking to identify higher risk borrowers as they look to reach more of the underbanked; Steve Chaouki, executive vice-president and head of TransUnion’s financial services business unit, says the integration “enables lenders to score approximately 95% of the US adult population” as reported by Banking Technology. Source.

The discussion at American Banker’s annual Digital Banking Conference in Austin last week revolved around new technologies like AI and...

In an effort to make youth sports payments easier and more efficient, Fiserv and Stack Sports have teamed up as Stack...

Fiserv‘s acquisition of First Data points to the power of fintech and the threat it poses to more traditional payments...

2019 has become a big year for fintech mergers and that trends look to continue for some time; payments in...

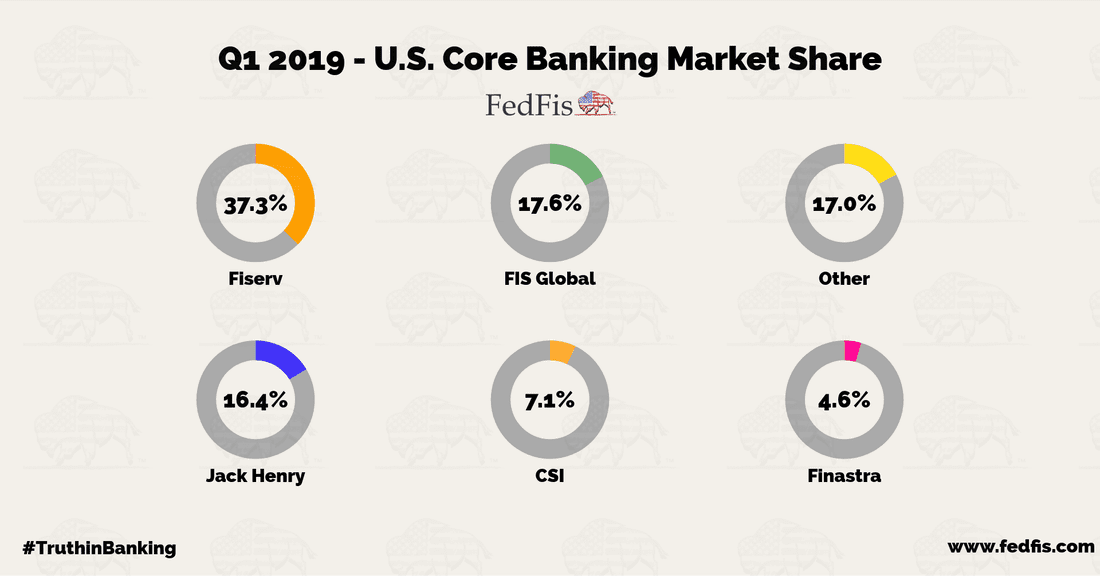

Data courtesy of FedFis.com shares that Fiserv has more than 37% market share; Jack Henry has the second highest market share with 17.6%, followed closely by FIS. Source

ICBA selects first fintechs for new accelerator program Partnerships, UX improvements and speed will drive money transfer in 2019 Brexit...

In an all-stock transaction of $22 billion, Fiserv has acquired First Data. The acquisition will allow Fiserv to now offer a...

Fiserv unveils new digital mortgage product, giving credit unions a leg up With the $3 billion alternative data industry exploding,...

Back in 2013 four core banking providers dominated the U.S. market owning a 96 percent share, that market share is...