A new report by the World Economic Forum shows that more than 40 central banks have begun some sort of...

The Cambridge Centre for Alternative Finance (CCAF), in partnership with the World Bank and the World Economic Forum, is conducting the most important survey in...

The report is titled "Beyond Fintech: A Pragmatic Assessment of Disruptive Potential in Financial Services"; in a brief summary of the report, the Word Economic Forum says: "Our findings suggest that fintechs have materially changed the basis of competition in financial services, but have not yet materially changed the competitive landscape. They play a critical role in defining the pace and direction of innovation across the sector but have struggled to overcome the scale advantages of large financial institutions."; the report is 196 pages and covers the major verticals in financial services. Source

This past summer the team from the Cambridge Centre for Alternative Finance (CCAF) in partnership with the World Bank and...

central bank / CBDCChinacivilization and politicsCryptoDAOsdecentralized financegovernanceIndiamacroeconomicsMetaverse / xRregulation & compliance

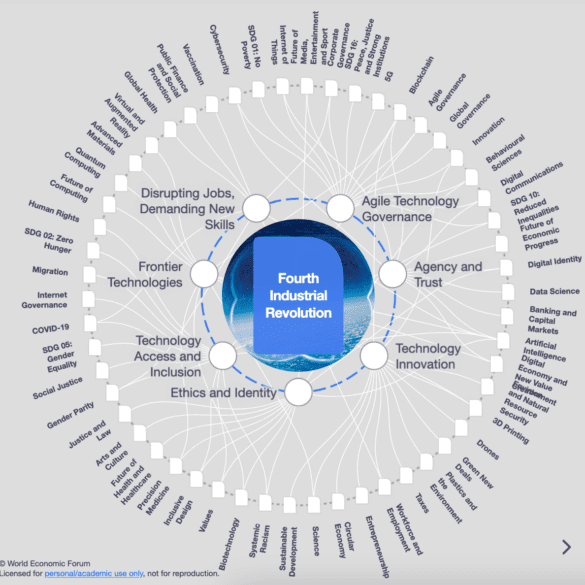

·In this conversation, we are so lucky to tap into the brilliant mind of none other than Sheila Warren who sits on the Executive Committee of the World Economic Forum and is a key member in the executive leadership of the Forum’s Centre for the Fourth Industrial Revolution (C4IR), in which she oversees strategy across the entire C4IR Network, consisting of centers in 13 countries. Sheila also holds board member and advisory positions at multiple institutions and organizations including The MIT Press (Cryptoeconomic Systems), The Organisation for Economic Co-operation and Development (OECD), NGO network TechSoup and she is a Member of The Bretton Woods Committee.

More specifically, we discuss her professional journey from small claims court to NGO Aid to refugees to corporate law to The WEF, touching on rational choice theory, corporate personhood and its correlation to the growth around ESG, new substrates, DAOs and protocols, artificial intelligence, the purpose of The World Economic Forum and its impact on governments and society alike, and just so much more!

As sustainability becomes central to the public eye, carbon emissions transparency is key. Connect Earth launch a sustainable investment API.

I examine the rising relevance of Central Bank Digital Currencies. We look at the World Economic Forum policy guide to understand different versions of CBDCs and their relative systemic scale, and the ConsenSys technical architecture guide to understand how one could be implemented today. For context, we also dive into a very different topic -- Lithium ion batteries -- and show how a change in the cost of a fundamental component part (e.g, 85% cost reduction in energy, or financial infrastructure) opens up a massive creative space for entrepreneurs.

Back in April I attended a couple of roundtable discussions in New York organized by the World Economic Forum. Many...

Speaking in Davos at the World Economic Forum, the CEO of Ripple, Brad Garlinghouse, shared that an IPO would be...

The most ambitious survey in the history of fintech is getting under way today. The Cambridge Centre for Alternative Finance...