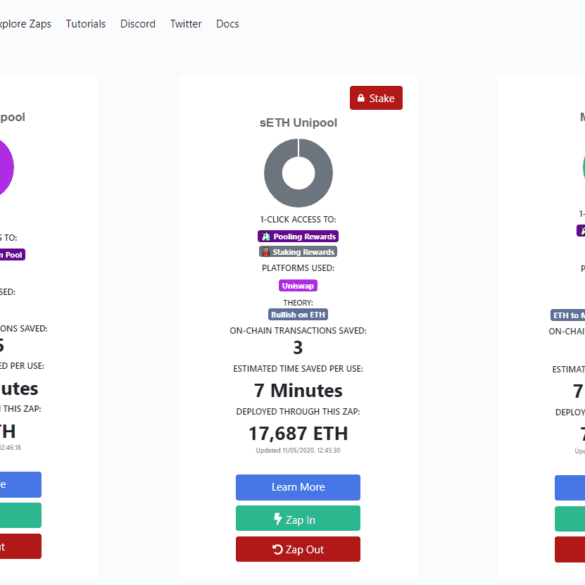

This week, I pause to reflect on the sales of (1) AdvisorEngine to Franklin Templeton and (2) the technology of Motif Investing to Schwab. Is all enterprise wealth tech destined to be acquired by financial incumbents? Has the roboadvisor innovation vector run dry? Not at all, I think. If anything, we are just getting started. Decentralized finance innovators like Zapper, Balancer, TokenSets, and PieDAO are re-imagining what wealth management looks like on Ethereum infrastructure. Their speed of iteration and deployment is both faster and cheaper, and I am more excited for the future of digital investing than ever before.

CFPB to give more information to firms under investigation The head of Credit Suisse’s blockchain efforts said culture is the...

ICBA selects first fintechs for new accelerator program Partnerships, UX improvements and speed will drive money transfer in 2019 Brexit...

Visa and Mastercard currently rank 7th and 11th on the S&P 500; their stock prices have increased around 50% over...

Card conglomerates, including Visa, Mastercard and American Express, grabbed multiple headlines in 2018 centered on their adoption of commercial cards as well...

China’s central bank as accepted Amex’s application to start a bank card clearing business, but they still need to receive...

Ping An pushes into Indonesia’s fintech space In strategic shift, TIAA to close dozens of mortgage offices Orca launches industry-wide...

Visa’s Margaret Reid on the future of passwords and financial products The SEC must solve its cryptocurrency custody conundrum After...

We started the month with the huge news that Square was acquiring Afterpay and we ended with Amazon’s deal with Affirm.

It seems like every day there is more news coming out of this sector, it is white-hot right now.

Banks and fintech firms are in competition over payments systems and each thinks real-time payments should be run differently; Bank...