Banks have started to come to terms with the importance of the cloud and what it means to their business;...

With the shift to work from home many banks are dealing with situations they might not have ever had to...

Visa, Mastercard Fined Wirecard for Dubious Transactions Mexico-Based Prop Tech Flat.mx Secures $25 Million in Debt Financing From Arc Labs...

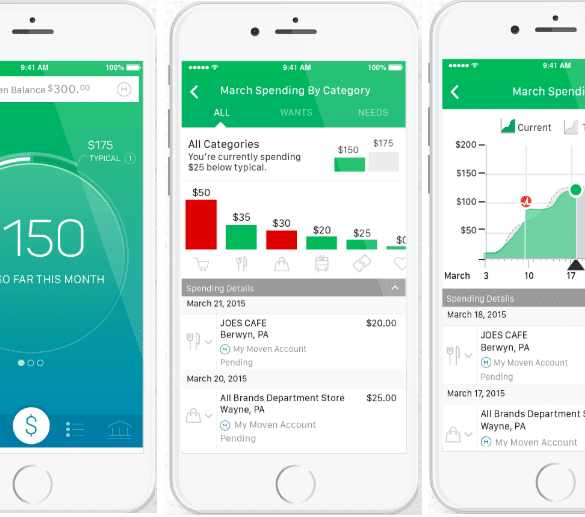

Moven has agreed to extend its exclusivity rights with TD Bank in Canada for another five years and broaden the agreement to the US; the exclusivity rights in the US are likely to result in a US launch of the partnership's money management tool, the MySpend app, which allows users to track spending and receive notifications; expansion of the white label app from Brett King's Moven is expected to add significant value for the fintech firm. Source

The problem of disparate data is something all banks have been struggling with and TD Bank seems to have found...

Some payment providers like Square have been in the news recently for the increases in withholdings during the crisis; Square...

Today we're joined by Brett King, founder and executive chairman of Moven, one of the world's original digital banks, and Lex Sokolin, global head of fintech at ConsenSys. Lex and I discussed Moven's recent announcement to shutter its B2C business on episode 170 of Rebank. And we're happy to have the opportunity to connect with Brett directly to discuss the decision in more detail.

On Monday, the Toronto-based, AI/ML-powered credit scoring company Trust Science announced the addition of Imran Khan, Global Head of Innovation at TD Bank, to the Advisory Board.

About a year ago TD Bank acquired the AI startup Layer6 and they hoped to use their technology to quickly...

TD Bank has signed a partnership agreement with nCino to digitize the bank’s corporate and commercial lending; the nCIno technology will allow for quicker lending decisions and more transparency; nCino’s Bank Operating system features CRM, loan origination, account opening, workflow, content management, business process management, customer engagement, and instant reporting all on a single platform according to Banking Technology. Source.