Could AI have prevented the SVB crisis? Maybe not completely, but consumer sentiment analysis could have dramatically reduced its impact.

In this conversation, we chat with Chris Dean, who is the Founder & CEO at Treasury Prime. Previously, Chris was the CTO & VP of Engineering at Standard Treasury, which was acquired by Silicon Valley Bank for an undisclosed amount.

More specifically, we discuss all things banking-as-a-service, FinTech APIs, embedded finance, and the general evolution of the FinTech banking industry over the last decade.

Cambridge Bancorp in Massachusetts formed an innovation group in 2016 and is now positioned to compete against bigger banks; head of the innovation Group Scott Chamberlin tells American Banker, “We spent a couple years proving … we could win business externally and, more importantly, internally from a credit standpoint. We’ve proven that out. This is year we start to add scale.”; the bank is looking to be an alternative to the likes of Silicon Valley Bank and Square 1; they see a differentiating characteristic being their local reputation and that they are in it for the long haul. Source.

This week we sat down with Michele to talk about the outlook for financial institutions an innovation in the wake of the SVB crisis.

This panel of experts will examine where we are headed and how a similar event can be avoided in the future.

The fintech news this week was dominated by the demise of Silicon Valley Bank, a fast moving story that took less than 48 hours to unravel.

The Silicon Valley Bank collapse highlighted the importance of a little-discussed but key feature of healthy banks and fintechs - backup servicing.

Revolut recently launched their service in the US and has made some recent hires; Bruce Wallace previously served as chief...

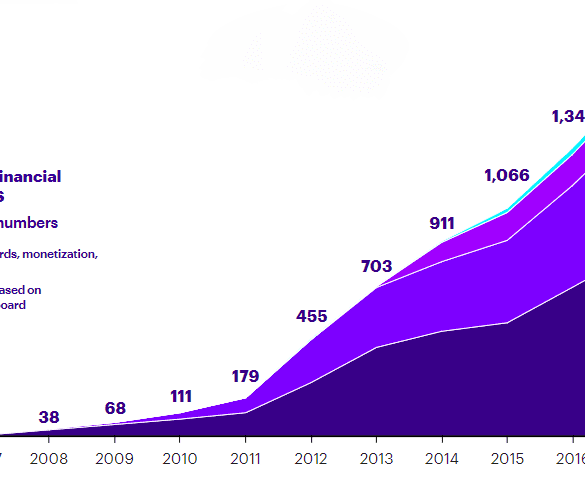

BBVA Compass, Capital One, Silicon Valley Bank, Citi, CBW Bank are some of the early adopters of open APIs that are beginning to transform how banking operates; the big question is how open will banking become and will it be mandated by legislation or will banks work with only those they trust; the one thing all banks are starting to do is make bigger investments into digital products, whether through partnerships or development as they see that the old way of banking will not survive. Source.

The week has ended in a bank run caused by the SVB's "classic balance sheet restructuring" actions. Some are asking, "who is next?"