Silicon Valley Bank has a joint venture partnership with Shanghai Development Bank Co. Ltd; the partnership led the bank to open its first Chinese branch in Shanghai in 2012 and the firm has now announced their second location in Beijing; the banking branch in Beijing has 14 employees and will offer services for companies in technology, private equity and venture capital which are a key focus for Silicon Valley Bank globally. Source

Cambridge Bancorp in Massachusetts formed an innovation group in 2016 and is now positioned to compete against bigger banks; head of the innovation Group Scott Chamberlin tells American Banker, “We spent a couple years proving … we could win business externally and, more importantly, internally from a credit standpoint. We’ve proven that out. This is year we start to add scale.”; the bank is looking to be an alternative to the likes of Silicon Valley Bank and Square 1; they see a differentiating characteristic being their local reputation and that they are in it for the long haul. Source.

American Banker takes a close look at how APIs are being used at some of the world’s leading banks and...

Welcome back to the Fintech Blueprint / Rebank podcast series hosted by Will Beeson and Lex Sokolin. In this episode, we talk through a few recent events that are indicative of the Fintech world right now. Brex raised an additional $150 million at a slightly improved valuation vs. its last round just as Monzo is reportedly looking at a 40% down round. Why? Shopify launched bank accounts for its merchants and announced the Shop app, basically an Amazon competitor plus Klarna, just as it worked with Facebook to support the launch of Facebook Shops and joined the Libra Association. Lots going on. Lastly, we discuss why Goldman’s M&A activity over the past couple years leads to the natural conclusion that they should buy Schwab.

In this conversation, we chat with Chris Dean, who is the Founder & CEO at Treasury Prime. Previously, Chris was the CTO & VP of Engineering at Standard Treasury, which was acquired by Silicon Valley Bank for an undisclosed amount.

More specifically, we discuss all things banking-as-a-service, FinTech APIs, embedded finance, and the general evolution of the FinTech banking industry over the last decade.

BBVA Compass, Capital One, Silicon Valley Bank, Citi, CBW Bank are some of the early adopters of open APIs that are beginning to transform how banking operates; the big question is how open will banking become and will it be mandated by legislation or will banks work with only those they trust; the one thing all banks are starting to do is make bigger investments into digital products, whether through partnerships or development as they see that the old way of banking will not survive. Source.

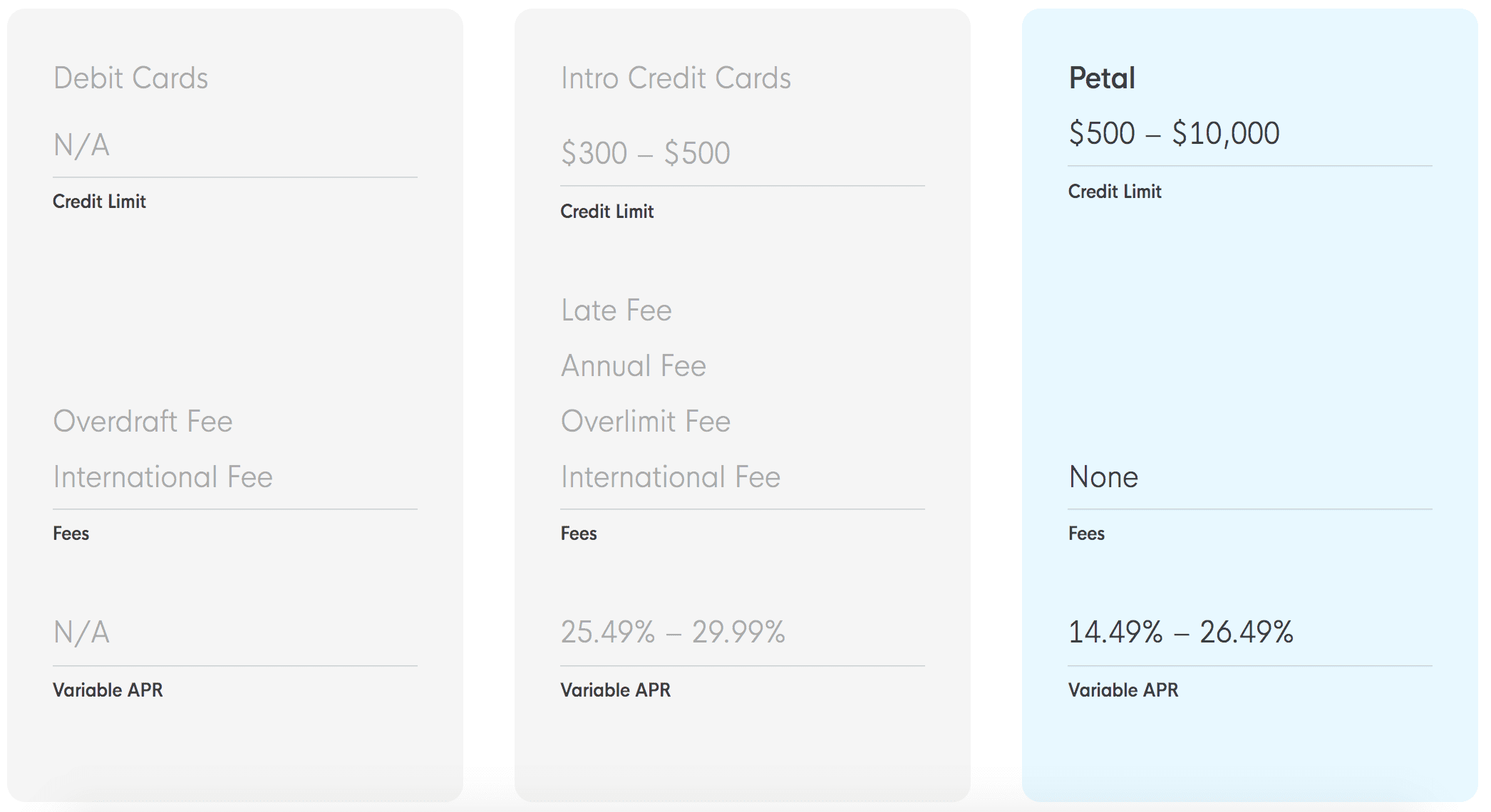

A majority of fintech companies today focus on providing faster and cheaper financial products to already well-served Americans. While this...

Revolut recently launched their service in the US and has made some recent hires; Bruce Wallace previously served as chief...

The British Business Bank (BBB) has approved The Bank of India and Silicon Valley Bank to deliver the Coronavirus Business...

The week has ended in a bank run caused by the SVB's "classic balance sheet restructuring" actions. Some are asking, "who is next?"