On CNBC's Squawk Box Ray Dalio, the founder of the world's largest hedge fund spoke negatively about bitcoin stating "It's not an effective storehold of wealth because it has volatility to it, unlike gold. Bitcoin is a highly speculative market. Bitcoin is a bubble."; he went on to say that it could be a currency and work conceptually but the speculation going on hurts it. Source

This week, we get philosophical and look at:

Embedded finance and how it will be woven into the fabric of the Internet

Applying the philosophies of existentialism, nihilism, and absurdism to Finance

Parsing symptoms in decentralized finance (Based Protocol) as artistic protest

Finding Dadaist beauty in chaos

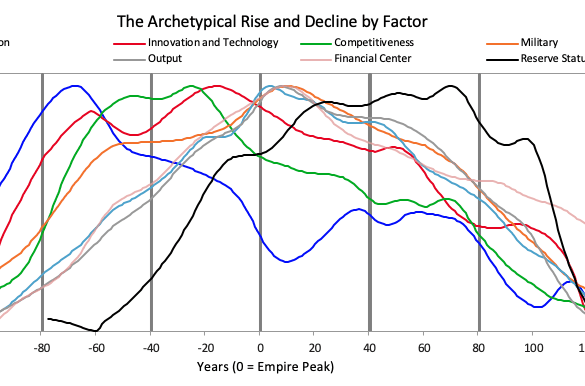

This week, we engage deeply with Ray Dalio's economic research about American Empire, capitalism, and the structure of money and credit. His clear ideas and model of the macro economy help connect the dots between emerging schools of thought, like Modern Monetary Theory and Market Monetarism, and the scarcity-focused philosophies of Gold and Bitcoin. This exploration will give you tools for understanding the $2 trillion printed by the US government, as well as potential associated impacts on finance and society.