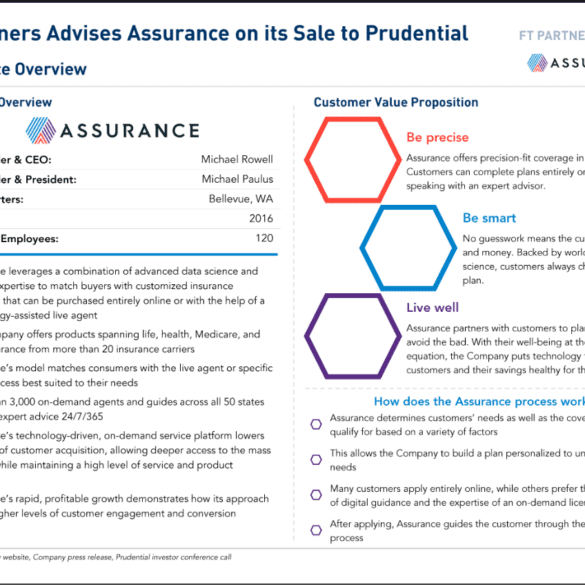

Assurance came on my radar courtesy of Financial Technology Partners, which was the investment banker on Assurance's $3.5 billion sale to Prudential. Notably, the company is just 3 years old -- which comes out to a cool billion of enterprise value per year, likely a record comparable to the very few Ant Financials. Depending on the details, this is about $25 million of value per employee. So what does the company do? Simple, really. It is a destination website licensed to sell all types of insurance product (e.g., life, health, auto), with a clean onboarding questionnaire like any other roboadvisor, which then matches against policies on offer from third parties. AI and data science are used as the recommendation engine. It is a Kayak or Money Supermarket of insurance, simply designed, cleverly wired, with killer founders.

Online loan marketplace LendingTree has released its third quarter list of top customer-rated network lenders; the platform has a network of over 450 lending partners; top lenders from each of the list's four categories included: Veterans United Home Loans, Lending Club, rateGenius and Credibly. Source

Overstock has been building out their FinanceHub for the past few months to include Overstock credit cards and insurance products, loans by LendingTree, Prosper and SoFi, a robo-adviser for automated investing and a discounted trading platform; Raj Karkara, Overstock VP of loyalty and financial services, tells TearSheet, “Consumers don’t want to sit and sign 50 documents, they just want to go online and get through the steps they need to take to move forward.”; the moves made are part of a broader strategy for the retailer to become a full service fintech firm that caters to their clients needs. Source.

Online multi-lender, LendingTree, has acquired CompareCards, owned by Iron Horse Holdings; the acquisition will expand LendingTree's online credit card comparison offering also bringing new technology, issuer relationships and educational tools to the site; LendingTree's stock has gained 13.44% following the company's announcement. Source

Today, we talk through a few recent events that are indicative of what’s important in fintech right now.

Varo raised $241 million in preparation to start operating under its own banking license later this year. Is a banking license an asset or a liability if you’re a digital bank?

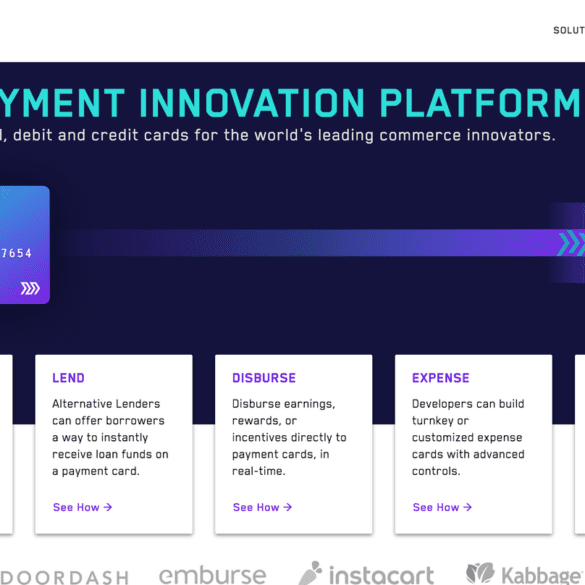

Marqeta is reportedly now valued at $4.3 billion, as banking-as-a-service continues its mature.

And LA-based fintech Stackin’ raised $13 million to scale its messaging-based offering designed to help Gen Z find the right fintech. What should we make of this?