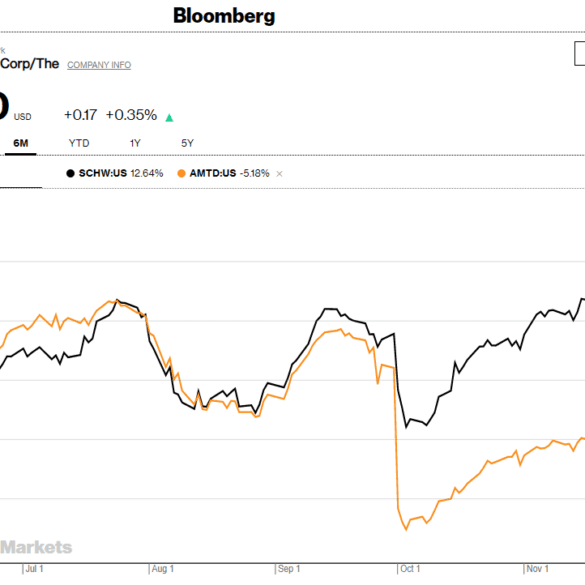

Well this morning started out as a bit of a bummer! See -- Charles Schwab to buy TD Ameritrade in a $26 billion all-stock deal. The $55 billion market cap Schwab is gobbling up the $22 billion TD Ameritrade at a slight premium. Matt Levine of Bloomberg has a great, cynical take on the question: Schwab lowering its trading commissions to zero is actually what wiped out $4 billion off TD's marketcap a few months ago. For Schwab, the revenue loss from trading was 7% of total, while for TD it was over 20%. Once Schwab dropped prices, TD started trading at a discount and became an acquisition target. You can see the share price drops reflected below in the beginning of October.

Cryptodecentralized financedigital lendingenterprise blockchainentrepreneurshipfixed incomeneobankroboadvisor

·Mike Cagney is the Co-Founder and CEO of Figure, a full stack financial services blockchain company with consumer offerings in market or on the way in lending, banking and more. In late-2019, Figure raised $103 million at a $1.2 billion valuation and continues to grow.

Prior to starting Figure, Mike co-founded and ran SoFi, one of the most successful consumer fintech companies ever.

In this conversation, we discuss Figure’s routes to asset origination and capital markets disruption, Figure’s previously unannounced consumer banking and payments offering, lessons learned building and scaling multiple billion dollar companies and more.

It was recently reported that JPMorgan Chase was entering the POS financing market; their entrance comes at a time when...

In the past some fintech companies and financial aggregators have accessed JP Morgan customer data by using user’s passwords; JP...

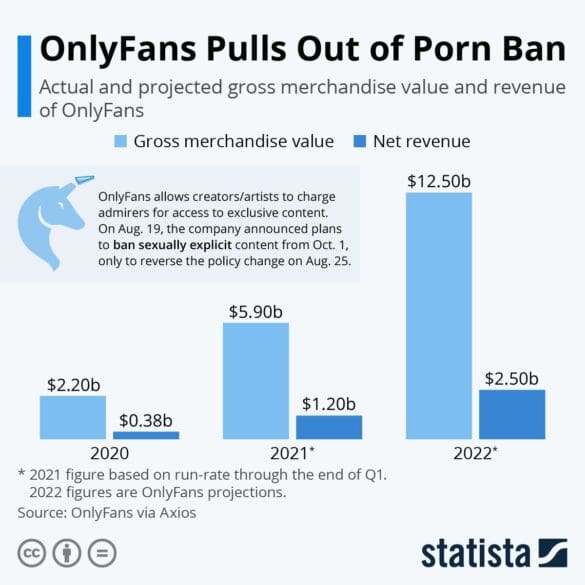

We talk about OnlyFans, and how its bank vendors pressured it to try to ban adult content, and how and why that failed. We also discuss the crypto tax provisions in the Senate version of the $1 trillion infrastructure bill, and their impracticality. These themes are tied together with a metaphysical hypothesis about the role of financial services, anchored in a discussion of the Platonic model of the mind. How are rationality, emotion, and social context involved to define the shape of our industry?

The news marks the first time a major US bank has created a cryptocurrency; the bank plans to start trials...

TechCrunch reports that JP Morgan is recruiting for a secret project based in London; while few details are known, the...

We are like the hungry at the all-you-can-eat buffet. In the beginning, there is not enough! Let's democratize access to food; to music; to transportation; to healthcare; to finance; to payments; to banking; to lending; to investing. The billions in institutional capital across universities, pensions, and sovereigns are delegated to smart portfolio managers. The day before yesterday, it was allocated by small cap stock pickers (hi Warren!). Yesterday, it was the alternative managers of hedge funds and private equity. Today, it is the trading machine and the venture capitalist. Tomorrow, it is the cryptographic artificial intelligence.

I examine the unbelievable transformation and restructuring happening in high finance. Global bank HSBC is planning to lay off over 10% of staff, looking at reductions of 35,000. E*TRADE is being acquired by Morgan Stanley, integrating its 5,000,000 accounts and $360 billion of assets into the Wall Street investment firm. Legg Mason and its $800 billion of assets are being folded into Franklin Templeton for $4.5 billion, less than what Visa had paid for fintech data aggregator Plaid and half of what Robinhood is likely valued privately. How do we make sense of these developments? How do we appeal to the heart?

big techcentral bank / CBDCdecentralized financedigital lendingdigital securities / STOenterprise blockchainexchanges / cap mkts

·This week, we look at:

How the music industry needed The Pirate Bay and Napster

Why J.P.Morgan is paying $1B in fines for allegedly manipulating the precious metals market

Whether DeFi is flirting with self-dealing and veering towards apathy

Why QAnon and 8chan are a bad example for global governance

And how the European Commission’s proposed crypto-market rules are highly productive for blockchain-based capital markets infrastructure