Finastra, R3 and seven global banks are teaming up to build a blockchain based marketplace for syndicated loans; banks include BNP Paribas, BNY Mellon, HSBC, ING and State Street; Fusion LenderComm, which uses R3's Corda platform, will be able to handle real-time credit agreements, accrual balances, position information and transaction data. Source.

Finastra CEO Simon Paris tells CNBC that European Banks are falling behind their U.S. counterparts when it comes to innovation;...

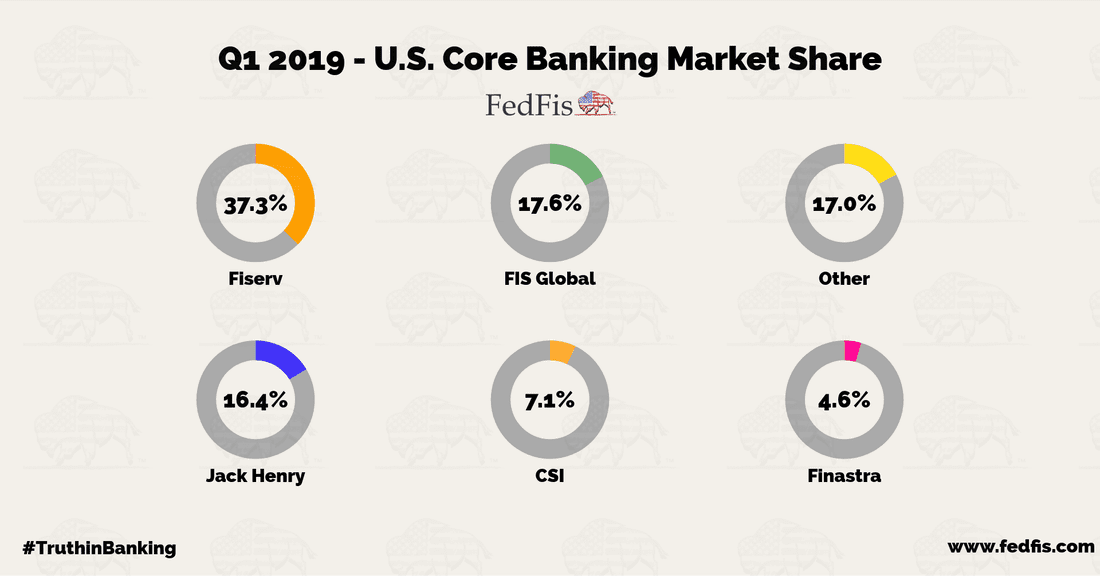

Finastra is still behind the three core technology providers Jack Henry, FIS and CSI; however they are launching initiatives in...

Back in 2013 four core banking providers dominated the U.S. market owning a 96 percent share, that market share is...

Fintech solutions are helping to lower the barrier to entry for women in emerging markets and the tools are beginning...

As real time payments have begun banks are finding it a challenge to implement them; how much should banks charge corporate clients for the service and how best to handle legacy infrastructure are two of the main questions they are grappling with; “Banks need to understand how they monetize these services,” Vinay Prabhakar, head of markets strategy for payments at Finastra, said to TearSheet. “Most banks have lucrative credit card programs, so how do they roll out RTP without cannibalizing their credit card models?”; Christopher Ward, PNC Bank’s head of treasury management product management, believes progress is being made and 90 percent of banks will have implemented real time payments by end of 2019. Source.

Newer core bank technology providers like Nymbus, Finxact or Finastra see an opportunity building with the rising trend in de...

Back in 2013 four core banking providers dominated the U.S. market owning a 96 percent share, that market share is...

The core banking provider market is starting to feel the winds of change as banks start seeking newer providers and...

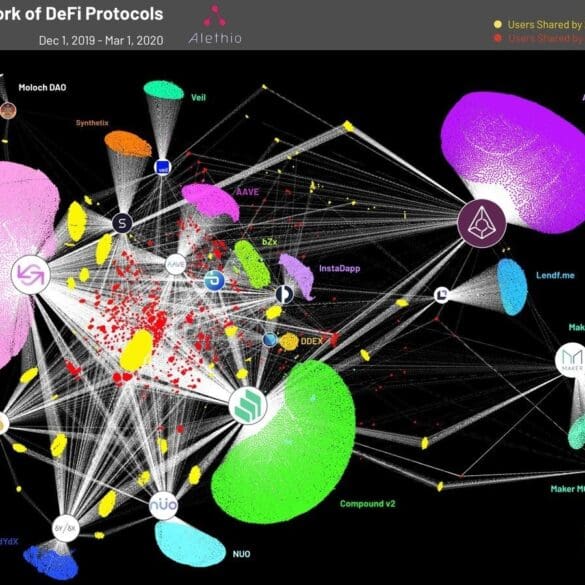

I anchor around the issues Libra is seeing in trying to develop a money, and what alternate strategies are available. We also analyze elements of a JP Morgan 2020 blockchain report, which highlights the differences between running a financial products (like a money) and a financial software (like a payments processor). In light of this necessary pivot for the regulated Facebook, we look again at Ethereum's decentralized finance ecosystem and the types of challengers it has created for Jack Henry, Finastra, Envestnet, TradeWeb, and other infrastructure providers.