With Figure in the news this week completing their first securitization using blockchain we thought it would be interesting to...

We look at some of the recent Fintech bundling news that boggle the mind. Neobank Chime just raised a mammoth round from DST Global, valuing it at $6 billion. Figure raised another $60 million round. Goldman is launching a retail roboadvisor. Revolut is offering pensions. Wealthfront is offering mortgages. The world is upside down. We cool down with pictures showing augmented reality implementations in commerce and finance, and finish with an elevated thought about the future.

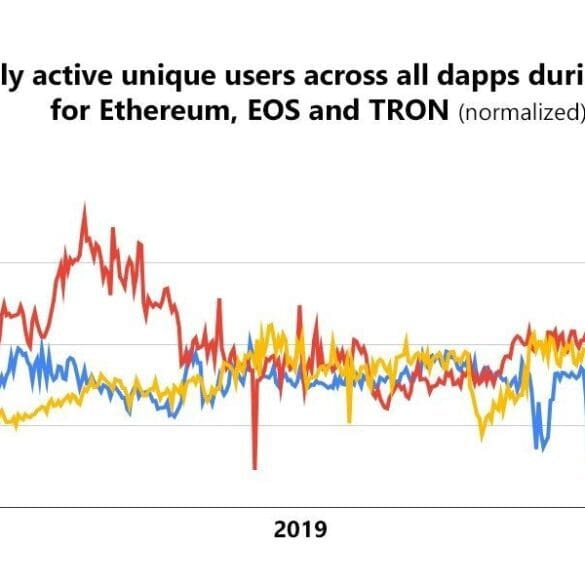

In the long take this week, I revisit decentralized finance, providing both an overview and 2019 update. The meat of the writing is the following long-range predictions for the space in the next decade -- (1) the role of Fintech champions like Revolut and Robinhood as it relates to DeFi, (2) increasing systemic correlation and self-reference in the space, which requires emerging metrics for risk and transparency, and (3) the potential for national services like Social Security and student lending to run on DeFi infrastucture, (4) the promise of pulling real assets into DeFi smart contracts and earning staking rewards, and (5) continued importance of trying to bridge into Bitcoin. Here's to an outlandish 2020!

The $150 million securitization of HELOCs is being billed as the first transaction where all aspects were managed on the...

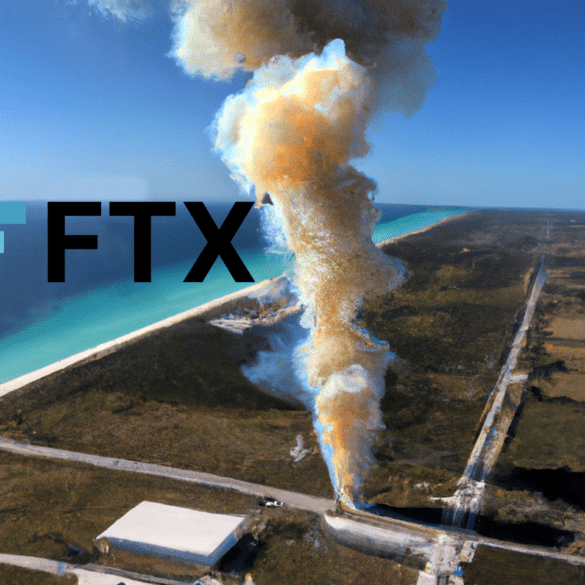

As the FTX avalanche rolls down the hill, fintechs worldwide hope to stay out of its destructive path.

Mike Cagney is one of the most successful fintech entrepreneurs with his founding of SoFi and now Figure; Cagney sat...

Mike Cagney has built a reputation as one of the smartest people in all of fintech. His capacity to raise...

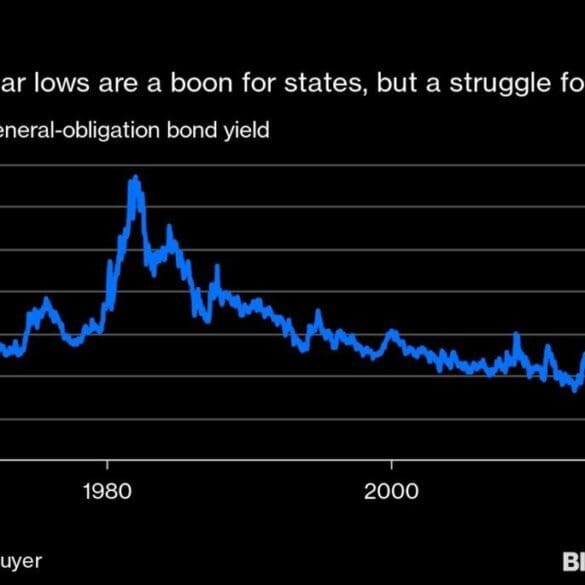

I reflect on ConsenSys acquiring a broker/dealer focused on municipal bonds, and why we believe that blockchain-native platforms are a fantastic fit for this $4 trillion asset class. Can direct holding of franctional munis enable deeper community participation and usage of common resources? Are there new sources of liquidity to unlock? At the same time, there are real dangers. I compare the evolution of digital lenders and their funding sources against the current possibilities in municipal bond markets. We also look into the reasons that some innovative Fintechs have failed to achieve their stated missions, and what can be learned and done better.

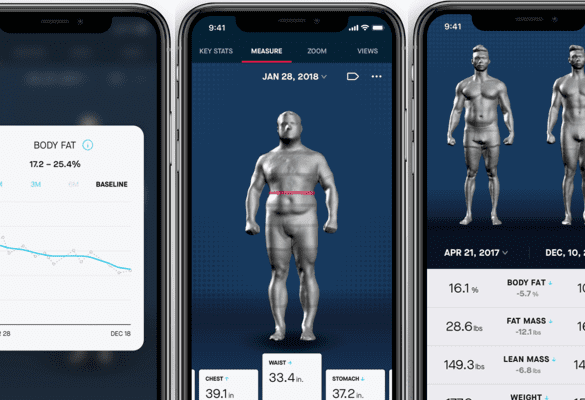

Cagney was previously the CEO of SoFi; his new venture focuses on home equity loans using blockchain to make the...

Blockchain based lending fintech Figure has seen a 300 percent surge in loan applications due to the recent rate cut...