As ethereum's merge looms closer we asked the digital asset community what they felt about the shift from PoW to PoS.

Every quarter we get together with three other families for a dinner party. While all professionals no one is in...

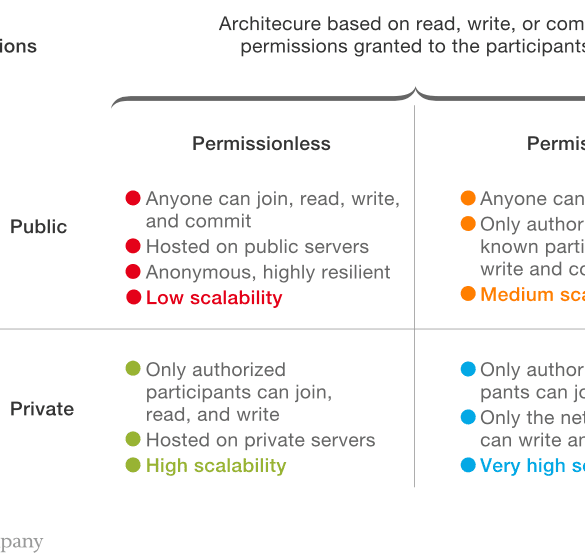

In this conversation, we talk with Patrick Berarducci of ConsenSys, about the valuations and multiples of capital markets protocols in Decentralized Finance on Ethereum, now making up over $60B in token value. Additionally, we explore the nuances of scaling Ethereum and its solutions, such as Metamask and the emerging Layer 2 protocols.

We also discuss law and regulation, including a fascinating story about Bernie Madoff from when Pat was a practicing attorney. This leads into a conversation about the embedded compliance nature of blockchain and crypto technology, the early days of ConsenSys, the path of crypto brokerages like Coinbase, and Metamask exhibiting emerging qualities of a neobank.

The crypto world was buzzing with the news of ethereum's successful shift to PoS. But what actually is staking? And why is it significant?

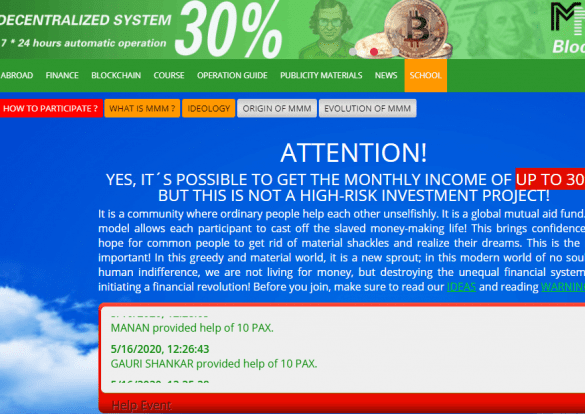

Let me introduce you to MMM. While decentralized finance and digital asset companies bend over backwards to be customer centric and reform financial services (each in their own way), MMM is a pretender. It is a pretender that has stolen the language of the crypto economy to create a cancer in its body.

digital transformationEmbedded Financeenterprise blockchainexchanges / cap mktsmega banksneobankOpen Bankingopen source

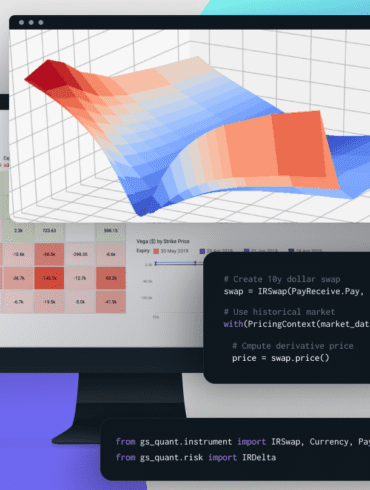

·In this analysis, we focus on Goldman Sachs launching an institutional embedded finance offering within Amazon Web Services, and Thought Machine raising a unicorn round for its cloud core banking platform. We explore these developments by focusing on the emerging role of cloud providers as distributors of third party software, think through some of the implications on standalone fintechs and open banking, and check in on AI company Kensho. Last, we highlight the difference between Web3 and Web3 approaches to “cloud”, and suggest a path as to how those can be rationalized in the future.

Coinbase announced they will add support for ERC20 tokens, the technical standard behind ethereum blockchain tokens; they don’t have plans to add any new token yet but is building out their technology to do so; "This is an infrastructure upgrade that will enable us to support many more assets in the future," a Coinbase representative told Business Insider.; the company did caution that they will wait regulatory clarity before adding any assets. Source.

This podcast features podcaster and author Laura Shin. She discusses the crypto space and her new book called The Cryptopians about the founding story of Ethereum and the ICO craze of 2017.

This week, we look at:

The Bitcoin money supply being worth as much as the M1 of several countries

The Visa/Plaid deal DOJ anti-trust filing and the PayPal integration of Bitcoin

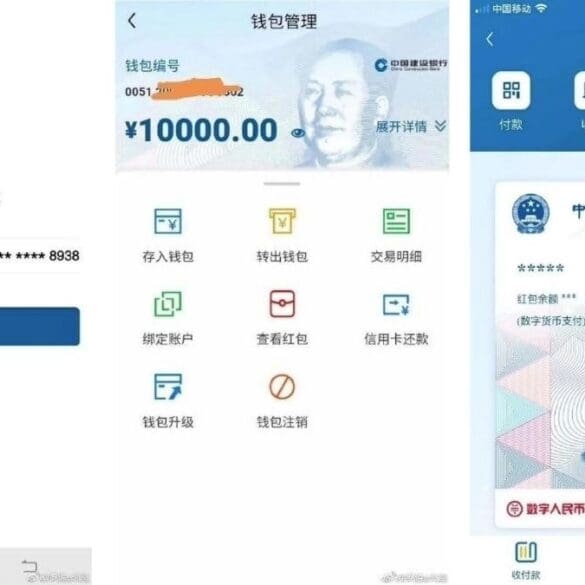

Understanding Central Bank Digital Currencies in the context of card networks, payment processors, and digital economies

Chinese CBDC and how it could relate to stopping the $34B Ant Financial IPO

How a CBDC ecosystem is like an operating system, rather than a payment rail

Fueling a renewed bull run, Ukraine used crypto to raise funds, while Russians bought crypto to evade their currency's collapse.