Envestnet has almost triple revenues in the last five years, in part because of their acquisition strategy; some are beginning...

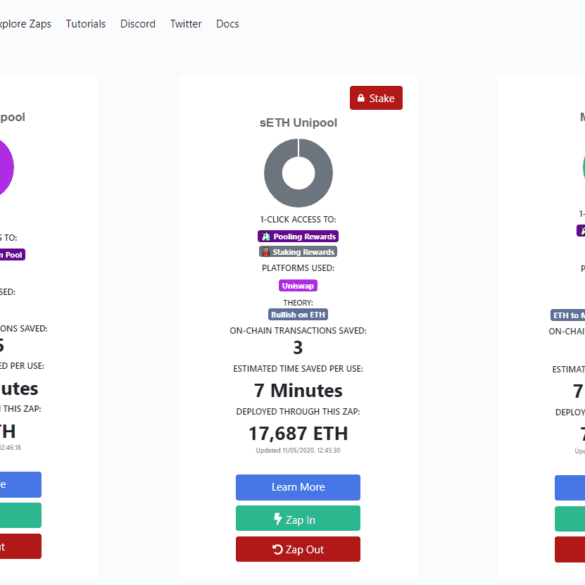

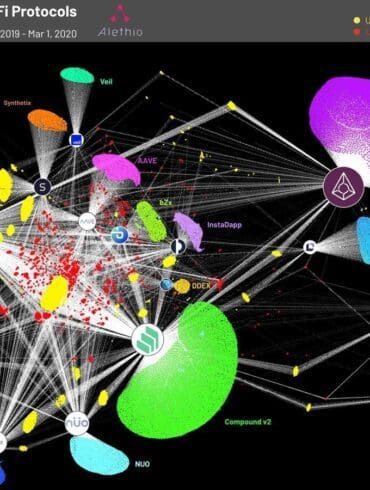

This week, I pause to reflect on the sales of (1) AdvisorEngine to Franklin Templeton and (2) the technology of Motif Investing to Schwab. Is all enterprise wealth tech destined to be acquired by financial incumbents? Has the roboadvisor innovation vector run dry? Not at all, I think. If anything, we are just getting started. Decentralized finance innovators like Zapper, Balancer, TokenSets, and PieDAO are re-imagining what wealth management looks like on Ethereum infrastructure. Their speed of iteration and deployment is both faster and cheaper, and I am more excited for the future of digital investing than ever before.

This week, we look at:

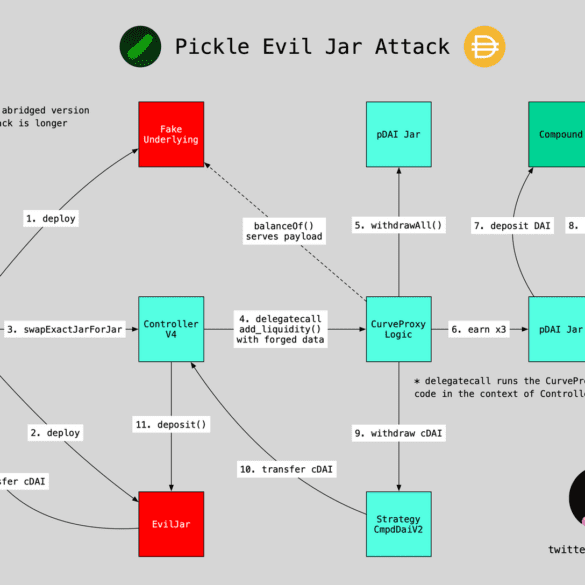

M&A in decentralized finance, focusing on the Yearn protocol and its targets Pickle, Cream, Akropolis

The motivations behind such M&A, and where economic value collects

The importance of community and security, creating increasing returns to scale

I anchor around the issues Libra is seeing in trying to develop a money, and what alternate strategies are available. We also analyze elements of a JP Morgan 2020 blockchain report, which highlights the differences between running a financial products (like a money) and a financial software (like a payments processor). In light of this necessary pivot for the regulated Facebook, we look again at Ethereum's decentralized finance ecosystem and the types of challengers it has created for Jack Henry, Finastra, Envestnet, TradeWeb, and other infrastructure providers.

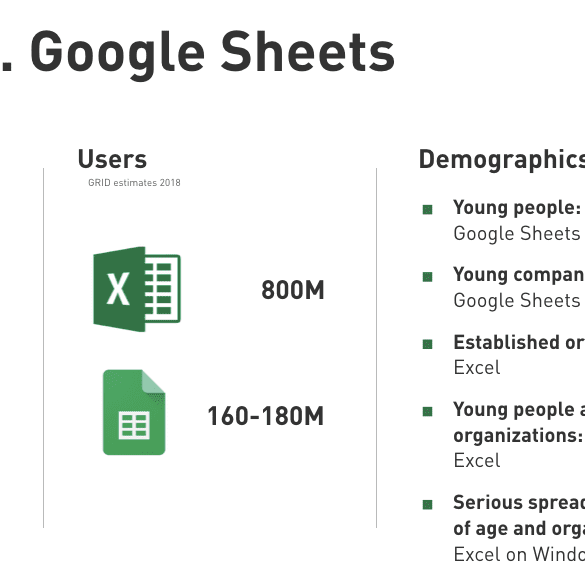

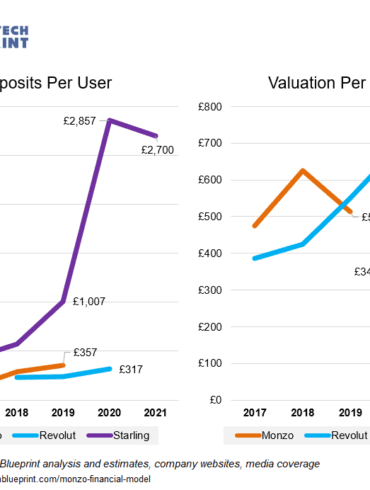

At $13 billion of revenue and 800 million users in 2016, Office 365 roughly generated $20 per user. That's like Monzo, but with the user foot print of Ant Financial.

You might think the comparison is daft. But let's dig a bit deeper. Excel, and spreadsheets more generally, are the default behavior for managing personal finances. Even for financial advisors, who are supposed to be the precise niche leveraging financial planning software, Excel is the default "do nothing" option. If you are not paying for digital wealth software as an advisor, you are doing it in Excel.

The fintech industry is coming up on the tipping point of funding, revenue generation, and user acquisition to rival traditional finance with $20 billion in YTD fintech financing, the several SPACs, and Visa’s $2B Tink purchased. Defensive barriers have eroded.

Let’s take a moment to compare capital. While it is not the money that wins markets, it is the transformation function of that money into novel business assets that does. And while the large banks have a massive incumbent advantage with (1) installed customers and assets, and (2) financial regulatory integration (or capture, depending on your vantage point), there is a real question on whether a $1 generates more value inside of an existing bank, or outside of an existing bank — even when it is aimed at the same financial problem.