Colombian fintechs have been very active in the VC space in 2024, with a number of startups raising over $150 million in funding so far.

At LendIt Fintech LatAm I also chatted with Angela Strange, a general partner at the well-known venture capital firm Andreessen...

The bank partner model has been around for decades but it has expanded rapidly in the last few years; leading...

Payments fintech Stripe announced three major upgrades to their payments platform to help users increase revenue, direct connectivity to major...

Brazil based digital real estate startup Loft has raised a $175mn series C round to help make the process of...

Instead of modifying decades-old transaction infrastructure, Spade provides better fraud protection by creating a new system. Customers like Sardine, Mercury, Unit and Ramp have improved their fraud models by more than 15% using Spade's real-time merchant intelligence for the card ecosystem.

According to Business Insider, fintech startup Synapse is laying off as many as 63 people or more than half of...

Digital banking is becoming more important than ever during the pandemic and leading VC Andreessen Horowitz believes branches are not...

Andreessen Horowitz is looking to raise $450mn for their second cryptocurrency fund after raising $350mn for their first fund in...

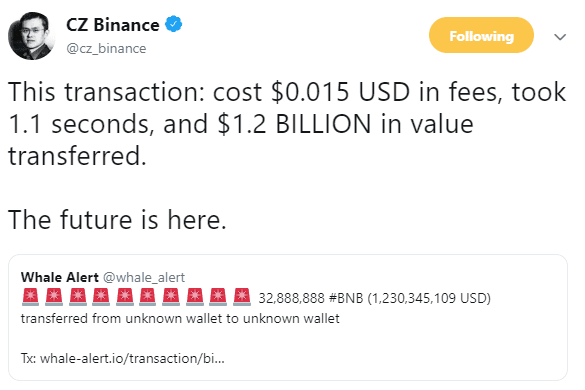

The web of investment bank technology, there are 20 or more core vendors on which systems run. Adding Blockchain to the mix merely adds a 21st system, which is by design incompatible with everything else. Thus enterprise chain projects have been focusing on integration and proofs of concepts, not re-engineering the core. But we know how this plays out -- as it has over and over again across Fintech. Digitizing "unimportant" channels and hoping for them to succeed simply doesn't work. See JP Morgan giving up on Finn, or Northern Trust capitulating its pioneering idea into Broadridge, or any other number of examples from Bloomberg to LPL Financial. Even the struggles of Digital Asset could be used as an example of the danger of working oneself into an existing web of solutions, and trying to preserve their dependencies.