The web of investment bank technology, there are 20 or more core vendors on which systems run. Adding Blockchain to the mix merely adds a 21st system, which is by design incompatible with everything else. Thus enterprise chain projects have been focusing on integration and proofs of concepts, not re-engineering the core. But we know how this plays out — as it has over and over again across Fintech. Digitizing “unimportant” channels and hoping for them to succeed simply doesn’t work. See JP Morgan giving up on Finn, or Northern Trust capitulating its pioneering idea into Broadridge, or any other number of examples from Bloomberg to LPL Financial. Even the struggles of Digital Asset could be used as an example of the danger of working oneself into an existing web of solutions, and trying to preserve their dependencies.

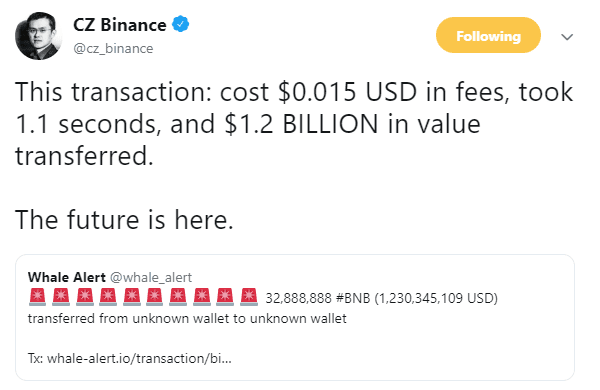

The second thing is that an addiction to frontier technology — crypto and artificial intelligence — was everywhere. Not from a Bitcoin speculation point of view, but from an operating, business model perspective. The question people are moving towards is no longer “Why?” but “How?”. If Goldman’s CEO is saying “Assume that all major financial institutions around the world are looking at the potential of tokenization, stablecoins and frictionless payments” — can we stop beating around the bush and just get to work?