Thin-file consumers can make a good credit bet

FICO has released a new product to help lenders figure out which consumers are most financially resilient and therefore better...

With Credit Karma in the news this week, we thought we would revisit a keynote given by CEO Ken Lin...

Indian banks are working with fintech startups to develop technology similar to what is used in markets like Africa and China; the banks hope to use social data and online shopping habits to underwrite borrowers; FICO recently began to offer credit scores in India using alternative data and there are many startups working on similar efforts. Source

The CEO and Co-Founder of Stratyfy, Laura Kornhauser, discusses how advanced AI underwriting models are now becoming more widespread in the banking system.

This is a guest post from Rob Snow, the Co-Founder and Managing Member at Carillon Capital, an investment banking and...

Douglas Merrill, the CEO of ZestFinance, writes in Forbes that more data for making an underwriting decision is usually better;...

In early 2018 we learned that more than 80% of borrowers taking up loans with Goldman Sachs’ Marcus had FICO...

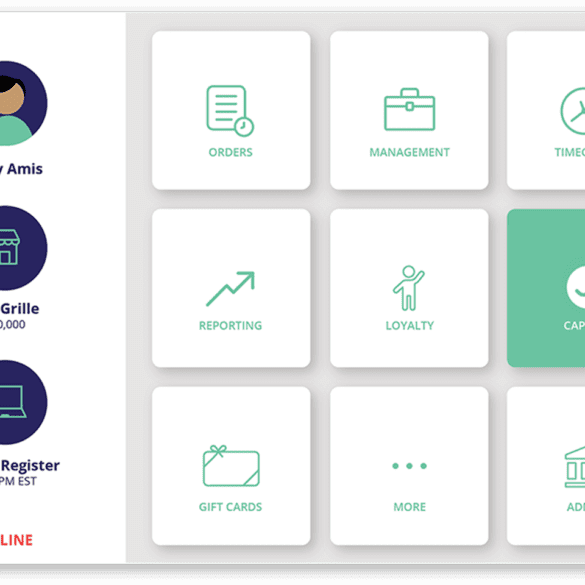

After coming out of 'stealth' with a $31 million Series B in August, the embedded lending architecture fintech jaris announced a partnership with HoneyBook.

David Lin, Head of Credit at PayU gives his take on expanding credit and how this looks in practice with their investment in Kreditech. Source