Upstart has been a pioneer in leveraging artificial intelligence in underwriting. They were talking about AI before any other online...

The CEO and Co-Founder of Stratyfy, Laura Kornhauser, discusses how advanced AI underwriting models are now becoming more widespread in the banking system.

Back in 2010 the management of Prosper took a gamble. They decided to do away with the auction model that...

Elizabeth Warren and Doug Jones are asking regulators to take a closer look at the tools that fintechs are using...

The average American checks their phone 47 times a day according to this study by Deloitte. The number is much...

We did something new this year at LendIt USA 2015. We hosted a series of pre-conference workshops that went into...

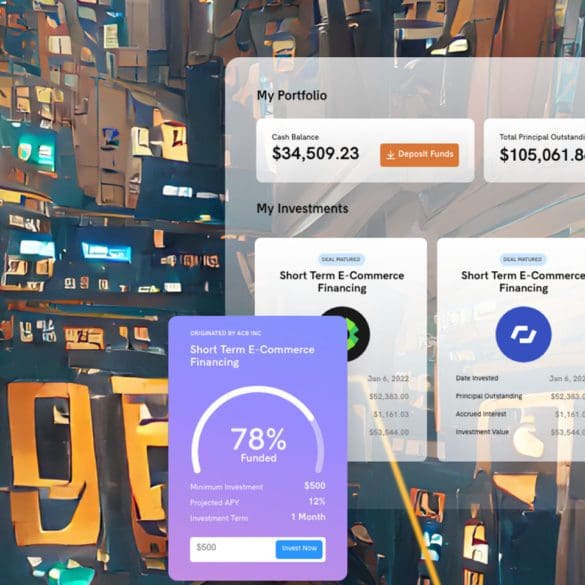

Taking on the estimated $9 trillion private credit market, Percent recently launched an all-in-one platform to help anyone underwrite in the private credit space.

David Lin, Head of Credit at PayU gives his take on expanding credit and how this looks in practice with their investment in Kreditech. Source

There are more than 5,000 credit unions in the United States according to the NCUA. Most of them are small...

After coming out of 'stealth' with a $31 million Series B in August, the embedded lending architecture fintech jaris announced a partnership with HoneyBook.