Mobility giant Uber kicks off its fintech business in Mexico, the latest move from the US company to ramp up financial services overseas.

This week, we look at:

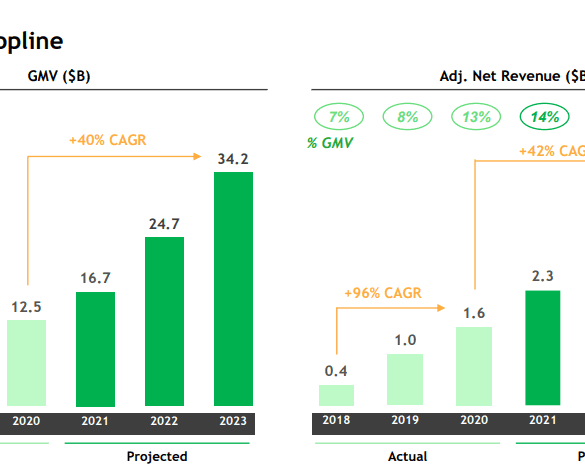

The economics of Southeast Asia’s largest super-app and its $40 billion SPAC valuation

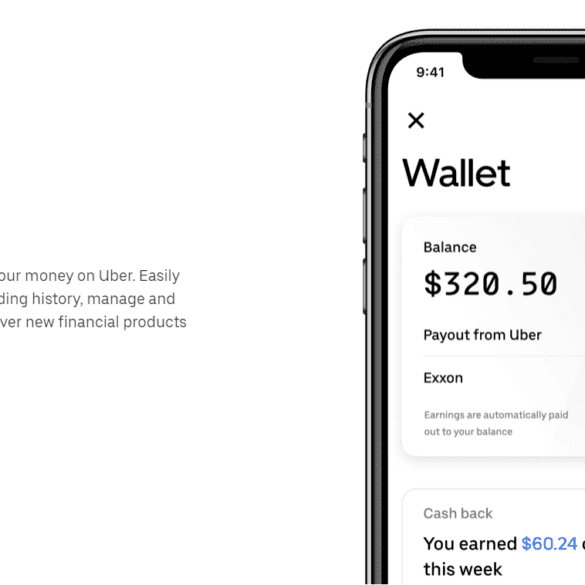

The industrial logic of building out financial features adjacent to the core business of transportation and delivery

Why this model has not worked for Uber, but has worked for Apple, and the broader impact on financial services.

This week, we look at:

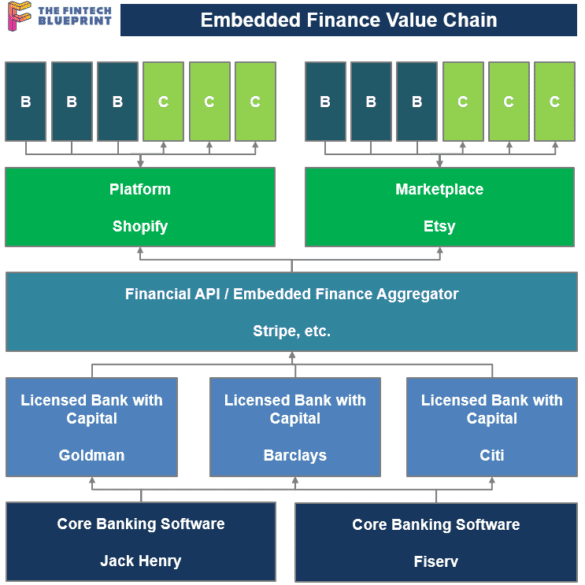

Embedded finance as a growing theme with the $10B Affirm IPO and Stripe's launch of Treasury

The customer types that each of these firms is attempting to convert into their product, and what this tells us about economic growth

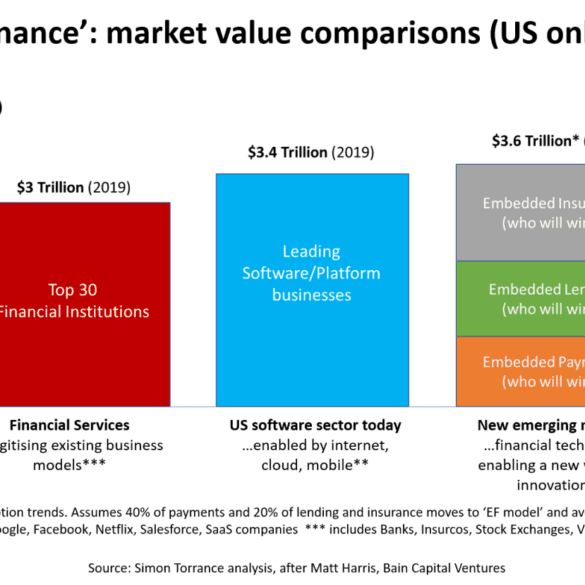

A framework for understanding the emerging value chain of digital finance, and the role of platforms and marketplaces

Online SMB lender Kabbage has built an app to allow Uber drivers to apply for PPP loans directly from their...

Uber has entered finance! The end is nigh! The boogeyman is here!

Oh. So what's involved? There's a debit card and a "debit account" powered by Green Dot, the same bank that's behind Apple Pay's person to person service. That means that Uber isn't a bank, but is renting shelf space on one. There's a wallet that will be integrated into the Uber app, within the driver's experience. So tracking your earnings and spending will be a feature that is part of the app -- not unlike what Amazon has had for years for merchants. There is a credit component, letting drivers withdraw money against their payckeck. And there's a Barclays credit card, private labeled for Uber, riding on the VISA rails.

Hear ye, hear ye, beware the disruption and tremble under its glory!

On Thursday, Uber partnered with Mastercard, Marqeta, and Branch to power the Uber Pro Card.

In this conversation, we talk all things embedded finance, platform banking, and APIs with Simon Torrance – one of the world’s leading thinkers on business model transformation, specializing in platform strategy, breakthrough innovation and digital ventures.

There’s an enormous gap between the financial needs of humanity and what the financial sector is able to deliver there. This gap is being filled by tech-savvy solutions and embedded finance plays which are putting into question the role of a bank in this new ecosystem.

Uber recently said they are de-prioritizing their finance related projects to better weather the current crisis; this comes only a...

civilization and politicsgenerational changemacroeconomicsmicroeconomicsnarrative zeitgeistphilosophySocial / Community

·Chlöe Swarbrick, a 25-year old climate MP was presenting her climate change case to the New Zealand parliament, and was heckled by an older audience member. Without missing a beat, she acknowledged and dismissed the challenger with a pithy “Ok, Boomer.”

The recording has since gone viral, inspiring everything from merchandise to Vogue articles. While the incident isn’t the source of the phrase “Ok, Boomer”, today it is the most well known manifestation. So what does the phrase mean? If you are inclined to more colorful language, see Urban Dictionary. But the meaning is obvious on its face — Gen Z is dismissing utterly and without consideration the judgment and protestations of society's elders on multi generational issues like economics, climate change, and social norms.

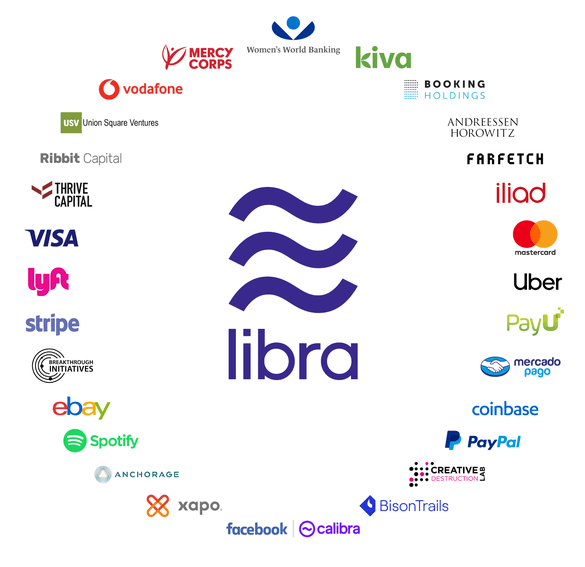

Jump is an electric bike that is being distributed by Uber, and it just happened to be launching 350 of them in the London borough of Islington. You can rent a bike for 5 minutes at £1, and pay £0.12 per minute thereafter. That's generally cheaper than a taxi, on average more expensive than a public bike subscription. So why am I going on an on about these bikes? Two things come to mind as jumping off points for deeper discussion: (1) the incentives and tactics of economic organisms under capitalism to gather and retain attention, and (2) the monopoly powers of Uber and Facebook, leading to the impact of Libra's cryptocurrency on open competition, as well as the public responsibilities of supra national corporations.