French based payments app Lydia has raised a $45mn series B round led by Tencent with existing investors CNP Assurances,...

The tech companies will become the storefront to absolutely everything.

There is no Internet, there is only Google.

There is no commerce, there is only Amazon.

There is no finance, there is only WeChat / Tencent?

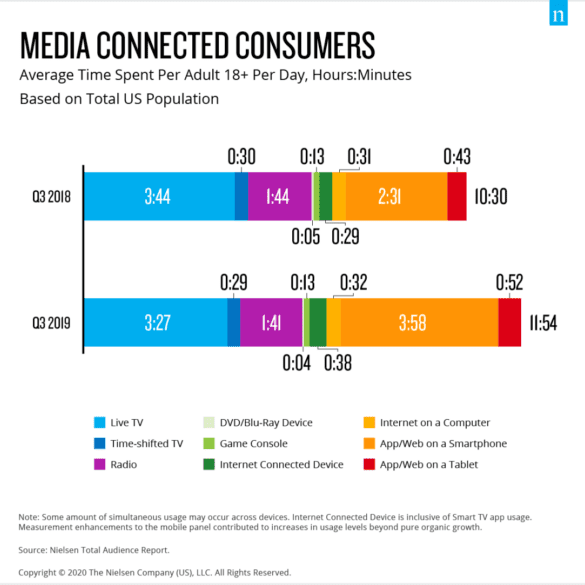

I don't know about you, but I cannot pay for anything in cash in London anymore. COVID has made the city go cashless. For China, QR codes have long replaced the need for paper money. And if there is no cash, what is the point of ATMs, and ATM fees, and bank branches, and bank branch staff? Financial firms no longer need to be the place where you shop for financial product.

China’s government has tried for many years to establish a credit system that rivals the U.S. and Europe, but has...

WSJ published a story on China’s consumer credit rating ecosystem: the fact that China doesn’t have a widely accepted system to gauge individual’s creditworthiness leads technology giants (Ant Financial, Tencent among others) to developing their own credit-rating systems, but none of these projects has emerged as a single nationwide standard either yet; problems with generating credit scores in the private sector include data accuracy and privacy; the story says the lack of a single accepted standard is holding back the growth of borrowing among rising middle class in China. Source

·

Before heading to Shenzhen the LendIt China tour visited with representatives from the wealth management arm of CreditEase. CreditEase is one...

Tencent, with advantages in cloud computing, big data, social networking, and mobile payments, will cooperate with China Development Bank to provide students loans; China Development Bank is a "policy financial institute" under the State Council; the bank covers over 90% of the student loans market. Source (Chinese)

One of the first posts I ever wrote on Lend Academy back in 2010 was about mulling the idea of...

Chinese giants Tencent and Ant Financial have found value in the buy now pay later industry with the companies buying...

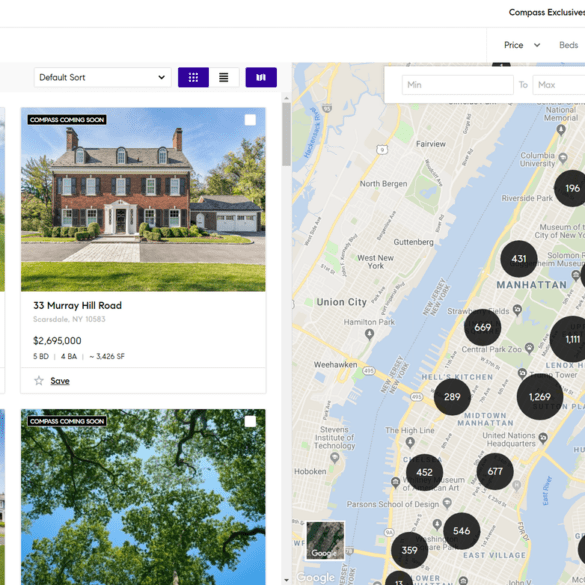

I examine how $6.4 billion real estate brokerage Compass stacks up against the digital wealth and lending companies with a similar go-to-market strategy, and provide some ideas as to why it is successful. Compelling questions also emerge when looking on how technologies like AR/VR are commoditizing the property brokerage experience. Compass, a residential real estate startup that built out a platform for brokers -- proprietary and external -- and has recently raised $370 million at a $6.4 billion valuation. I found the language and positioning sort of eery, in how similar it was to the story in industries I closely follow. It even bought a CRM earlier this year, not unlike AdvisorEngine buying Junxure, or Salesforce getting into financial verticals. What I did find unusual, was the absolutely massive valuation.

The Shenzhen Securities Regulatory Bureau issued the year’s first fund sales license to Tencent Holdings; the company will operate as Teng An Fund Sales; WeChat adds a police certified facial recognition technology as part of a pilot program they hope to roll out to all of China in late January; some loans on HNA’s p2p platform JBH have dealt with deferred payments a since November. Source.