Inter-bank payments platform Swift says it is a step closer to adopting blockchain; a project that could potentially move member bank accounts to the blockchain and provide for real time reconciliation is now ready for its next phase; the project is focused on dormant funds held in various currencies supporting transactions. Source

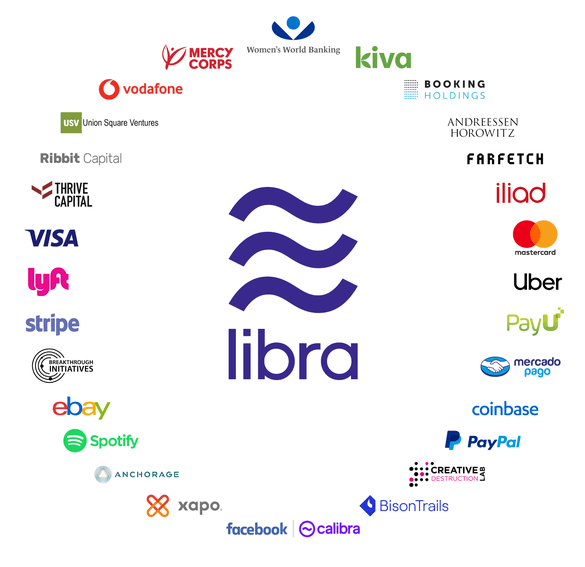

A digital world needs digital money, and a few influential players are actively working to build it. China's BSN initiative and Facebook's Libra embody the East's public sector led approach to building and owning the internet of value and the West's private sector led (and public sector challenged) attempt at cheaper commerce on the web. While the nature of the approaches may be different, the data and privacy considerations are eerily similar. For all of our past episodes and to sign up to our newsletter, please visit bankingthefuture.com. Thank you very much for joining us today. Please welcome Lex Sokolin.

Swift says that blockchain technology is not yet ready to handle the billions in daily cross border bank payments; they recently completed a proof of concept test to reconcile international payments between 34 banks; they said the test went well but that progress was still needed before they can trust the technology to handle the scale; the other aspect to consider is that the 11,000 thousand banks on the Swift system would still need to make upgrades to switch to blockchain based payments. Source.

SWIFT says that digital heists are on the rise as hackers are becoming more sophisticated in their tactics; they are recommending that banks increase security of computers used to transfer money; a Bangladesh Bank lost $81 million back in February, 2016 and there are more recent examples of hacks; the report provides details on the new methods hackers are using. Source

Jump is an electric bike that is being distributed by Uber, and it just happened to be launching 350 of them in the London borough of Islington. You can rent a bike for 5 minutes at £1, and pay £0.12 per minute thereafter. That's generally cheaper than a taxi, on average more expensive than a public bike subscription. So why am I going on an on about these bikes? Two things come to mind as jumping off points for deeper discussion: (1) the incentives and tactics of economic organisms under capitalism to gather and retain attention, and (2) the monopoly powers of Uber and Facebook, leading to the impact of Libra's cryptocurrency on open competition, as well as the public responsibilities of supra national corporations.

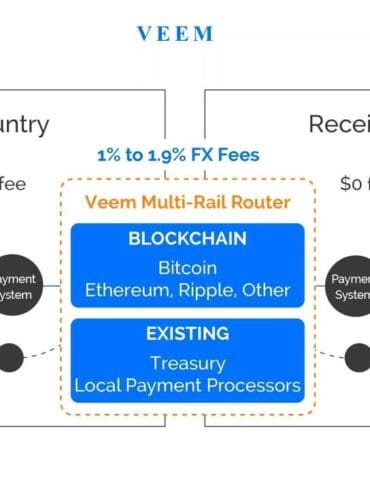

In this conversation, we talk with Marwan Forzley of Veem about how the rampant evolution of the mobile phone spurred his fascination to turn the phone into a business-to-business (B2B) payments network. Additionally, we explore how generations of companies have tried to use correspondent banking to solve for B2B cross border and failed, the intricacies of payment rails and the infrastructure to support them, the impact of COVID on global e-commerce, how the future will blend the distinctions between digital wallets, banking services, and crypto wallets.

International payments network Swift has created their alternative to blockchain which they believe is a better, more reliable solution; global...

Here are the most read news stories from our daily newsletter today: OCC chief expects SWIFT-like bank-to-blockchain connections in 3...