The week has ended in a bank run caused by the SVB's "classic balance sheet restructuring" actions. Some are asking, "who is next?"

It was one of the most tumultuous weekends in the history of fintech, as federal regulators and government agencies took swift action to stop the bleeding after Silicon Valley Bank suddenly collapsed.

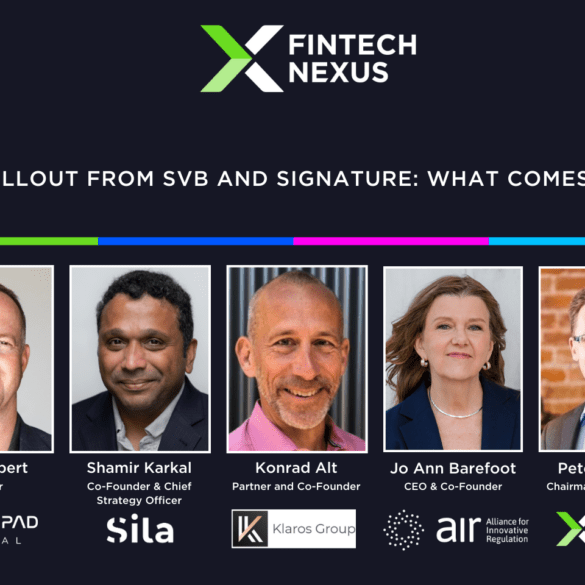

This panel of experts will examine where we are headed and how a similar event can be avoided in the future.

As the dust settles after the SVB fall, leaders are looking at ways forward. Many think fintech might have the upper hand.

A week on from Silicon Valley Bank's fall, Fintech Nexus hosted a webinar to discuss what happened and what's next for the institution.

The fintech news this week was dominated by the demise of Silicon Valley Bank, a fast moving story that took less than 48 hours to unravel.

Over the weekend regulators raced to find a resolution for the waves made by SVB's demise. Failure of the financial system may be adverted.

Days after the chaos, newly appointed CEO of the SVB bridge bank urges customers to hold deposits. Meanwhile regulators investigate the fall.

The whole of finance has felt SVB's ripples. Crypto is no exception. Some are evaluating DeFi as a influencer of changes to the system.

We will be live-updating the Silicon Valley Bank crisis story as new developments emerge through the weekend.