Fiserv‘s acquisition of First Data points to the power of fintech and the threat it poses to more traditional payments...

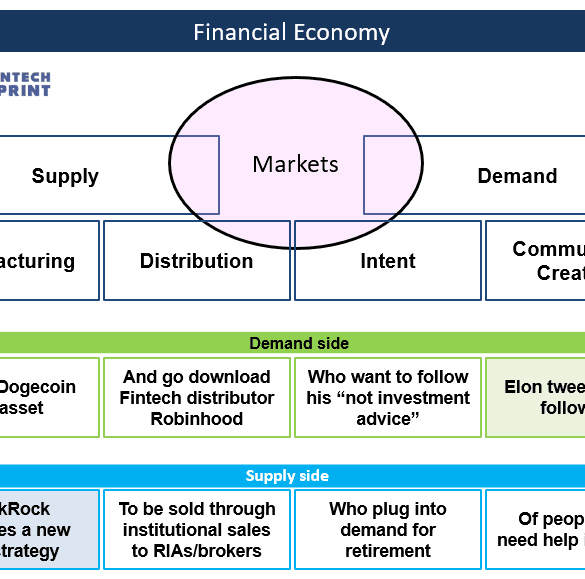

Square upgrades Cash App into a payment processing powerhouse, completing the loop between the consumer and merchant side of the house. Goldman Sachs acquires GreenSky, adding a lending business at the point of intent. This analysis connects these symptoms into a framework explaining the increasing integration between commerce and finance, and the increasing role that demand generation plays. That in turn explains how the attention and creator economies interconnect with financial services.

The largest online small business lender in the US is now PayPal having done $4 billion in loans in 2018;...

American Express and Square announced on Nov. 16 a plan to launch a new credit card explicitly built for Square sellers on the AmEx network.

Chinadigital lendingeCommerceMetaverse / xRneobanksmall businessSocial / Communitysuper appsupply chain / trade

·This week, we cover these ideas:

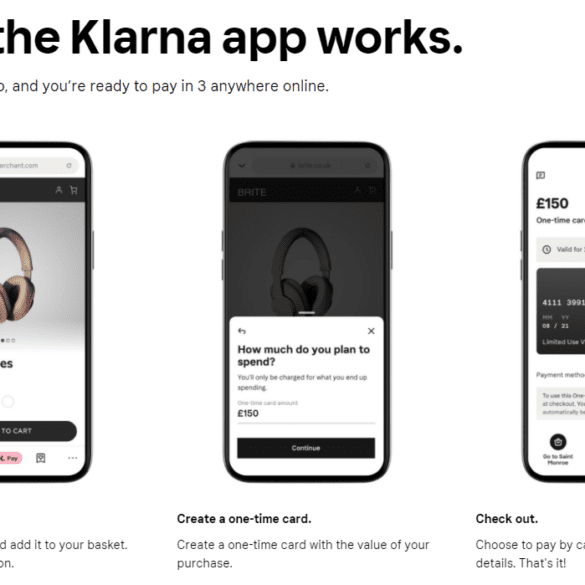

Klarna’s $640 million raise and its $45 billion valuation, and how its business model arbitrages the payments revenue pool to build a lending business

Pinduoduo’s growth path to a $150B marketcap, and the links between shopping, media, and financial mechanisms that help it compete with Alibaba

A comparison of approaches to growth and economics

Implications for crypto assets for capturing “the real economy”

Klarna is raising $640 million on a $45 billion private valuation, with over $1 billion in net operating income. The buy-now-pay-later company has over 90 million active customers and 250,000 merchants. It was founded in Sweden in 2005.

On the other side of the ocean, Chinese ecommerce company Pinduoduo is beating Alibaba with 820 million active buyers, generates over $3 billion in revenue per quarter, connects buyers to 12 million farmers, and has a market capitalization of $150 billion. It was founded in China in 2015.

Square has been one of the best performing fintech companies during the pandemic and their stock has risen to record...

Ron Shevlin digs into Square and why the company and its stock price continues to do very well; he looks...

All of the leading online lenders are struggling as the economic crisis continues to get worse; many have cut originations...

“Bitcoin, for us, is not stopping at buying and selling," Square CEO Jack Dorsey told analysts on their earnings call as reported by Business Insider. "We do believe that this is a transformational technology for our industry and we want to learn as quickly as possible."; bitcoin has yet to effect Square’s earnings as they have only recently started crypto payments; they currently include a margin to account for the volatility of bitcoin; shares were down slightly after releasing earnings. Source.

Colombian fintechs have been very active in the VC space in 2024, with a number of startups raising over $150 million in funding so far.