Several of the largest fintechs in Mexico have plans to step up loans to small and medium-sized businesses in the country.

'It would be very strange for a fund the size of Softbank to change its investment policy due to losing part of its staff, no matter how key people are.'

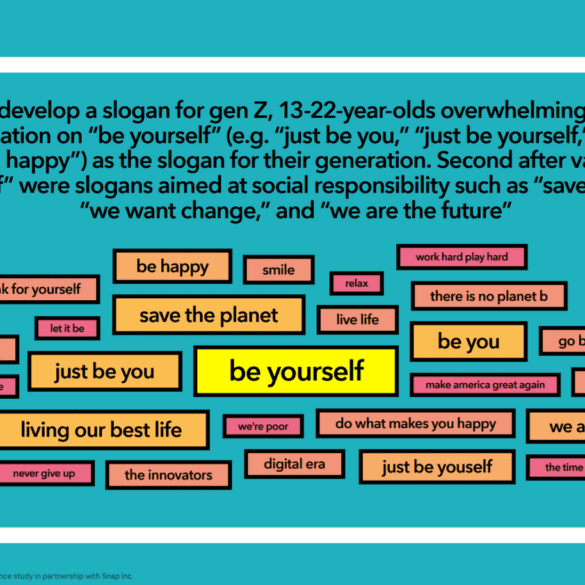

Gen Z is becoming a cultural force, reshaping culture and online society. This is starting to echo in fintech startups and crypto protocols. We explore how financial communities are beginning to congeal into DAOs, their nature and structure, and potential longer terms outcomes. The analysis identifies the differences in Millennial and Gen Z approaches — however imperfectly — to explain the frontier of social tokens and why ShapeShift chose decentralization, while Revolut chose decacorn funding.

DAOs are not socialist communes built for the benefit of humankind. Rather, they are techno-fortresses to defend, and make valuable, exclusive online tribes.

Whereas Millennials dream about a VC-funded unicorn startup, permissioned into wealth with capital from traditionally successful investors, Gen Z and crypto natives dream about bottoms-up community syndicates with trillions to spend on the sci-fi future, unshackled from regulatory overhang and the sins of the 2008 quantitative-easing past.

Several SoftBank executives held calls last month to discuss potential legal risks with their large investment into Wirecard so soon...

Accounting firm Ernst & Young failed to request bank statements from the Singapore bank that the fintech claimed to have...

The Brazilian digital lender added $200 million in its ninth funding round and announced it was buying both a bank and a mortgage lender.

Here are the top 10 quotes, among the many keynotes, panels, and conversations at LendIt fintech LatAm Miami Last week.

This week, we look at:

PayPal and Square being larger than Bank of America and Goldman Sachs

The SoftBank $4 billion in tech oligopoly call options, and why people feel uneasy

Uniswap vs. SushiSwap, and Bitcoin vs. Litecoin, and why these forks felt wrong

How understanding signalling can help make better decisions

Last year SoftBank agreed to make a €900mn investment into Wirecard; as part of the deal they were going to...

Insurtech leader Lemonade has filed to go public; the company is backed by an A-list group of venture capitalists including...