SoFi reported financial results for Q4 2023 showing 35% revenue growth and its first ever quarter of profitability

The canary is now 10+ years old as prominent platforms like SoFi and Upstart launched in the early 2010s, and Freedom Financial (now Achieve) has been around for two decades.

SoFi is the first bank to begin 'Pay in 4' within the Mastercard Instalments program that began in Mid-December.

The first fintech to go public in the new year, the Dave challenger banking app went live on the Nasdaq Thursday, after a successful merger with a Victory Park SPAC.

We focus on the law of unintended consequences, and how making rules often creates the opposite outcome from the desired results. The analysis starts with the Cobra effect, and then extends to a discussion of the Wells Fargo account scandal, dYdX trading farming, Divergence Ventures executing Sybil attacks, and Federal Reserve insider trading. We touch on the concepts of credit underwriting and token economies, and leave the reader with a question about rules vs. principles.

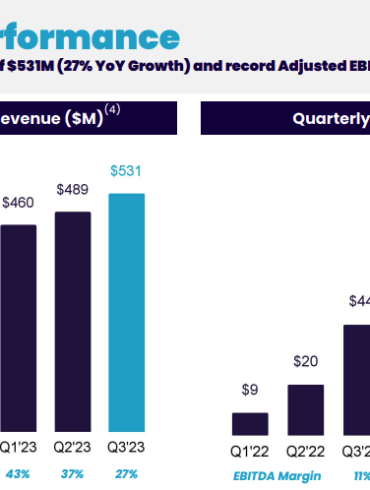

SoFi reported their financial results for Q3 2023 and showed considerable improvements across all areas of their business.

Sofi's student loan volumes are down, but analysts showed excitement about the company's growth in deposits.

SoFi reported fourth-quarter GAAP Revenue was $286 million, up 67%, and $984.9 million for the year, up 74% from 2020.

This earnings season started strong but turned uneven this week. Even firms that showed outsized growth saw their stock prices...

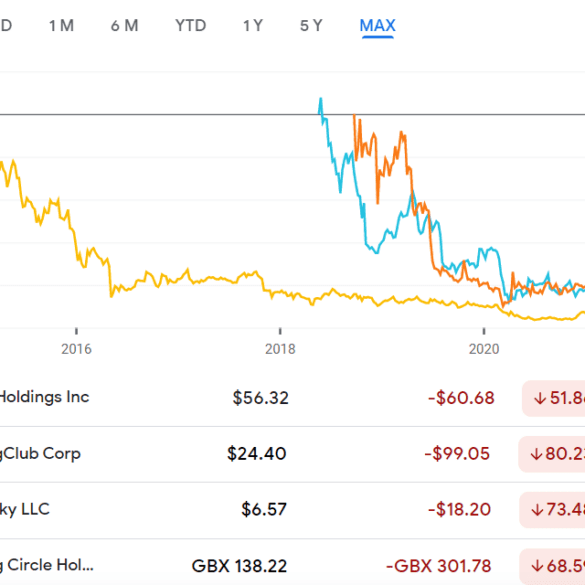

We look in detail at the state of marking recently-private-fintechs to the public market in mid-2021. Multiple industry segments have seen IPOs, direct listings, and SPACs transition fintech darlings into traditional stocks. How is performance doing? Is everything as magnificent and rich as we expected? Have multiples and valuations fallen or held steady? The analysis explores the answers and provides an explanatory framework.