There was a lot of anticipation of what might happen in the UK as lawmakers put in place the Payment...

Writing in AltFi Steven Bisoffi, Payments Advisory Lead at Huntswood, asks if 2019 will be the year that open banking will...

Big Banks vs. Silicon Valley Startups – Whose Customer Financial Data Is It Anyway? Mixed Bank Earnings; PeerIQ’s Modeling Archive...

Tink raised €56 million in new funding in February and today it announced a further investment of €1o million from...

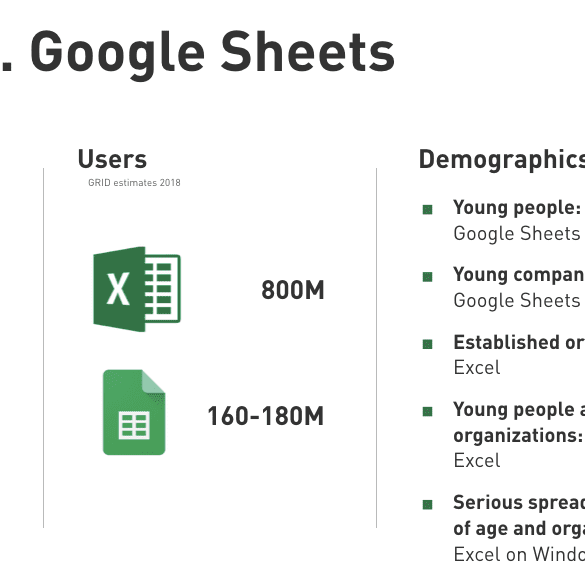

At $13 billion of revenue and 800 million users in 2016, Office 365 roughly generated $20 per user. That's like Monzo, but with the user foot print of Ant Financial.

You might think the comparison is daft. But let's dig a bit deeper. Excel, and spreadsheets more generally, are the default behavior for managing personal finances. Even for financial advisors, who are supposed to be the precise niche leveraging financial planning software, Excel is the default "do nothing" option. If you are not paying for digital wealth software as an advisor, you are doing it in Excel.

Alibaba’s Alipay was granted an eMoney license in Luxembourg to allow the company to serve customers across Europe; the eMoney...

According to new research by open banking platform provider Tink 41 percent of European banks failed to meet the latest...

In an op-ed in the FT, the chairman of BBVA, Carlos Torres Vila, argues for the expansion of European open...

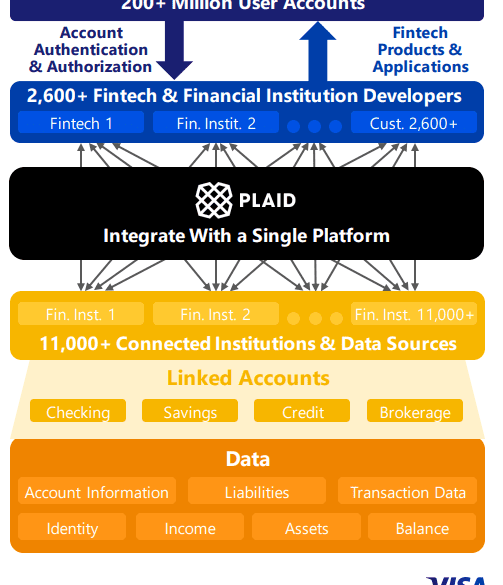

I dig deeply into the $5.3 billion acquisition of data aggregator Plaid by $500 billion payments network Visa. We examine why this deal is worth 25-50x revenue, while Yodlee's sale to Envestnet was priced much lower. We also look at how Plaid could be an existential threat to Visa, and why paying 1% of marketcap to protect 200 million accounts may be a good bet. Broader implications for product manufacturers across payments, investments, and banking also emerge -- the middle is getting carved out, and infrastructure providers like Visa or BlackRock are moving closer to the consumer.

No More Content