AltFi takes a look into the future at what the new Payment Services Directive will mean when it takes effect in 2018; companies will learn a great deal by trial and error as this is a new market and new markets need time to grow; client on boarding using KYC and AML requirements will be a key test for global banks who need to comply with the directive; open banking might also allow for banks to come across new customers that they might not have had access to in the past; ultimately client value is the biggest takeaway and open banking has the ability to deliver more to the client. Source

Big Banks vs. Silicon Valley Startups – Whose Customer Financial Data Is It Anyway? Mixed Bank Earnings; PeerIQ’s Modeling Archive...

According to new research by open banking platform provider Tink 41 percent of European banks failed to meet the latest...

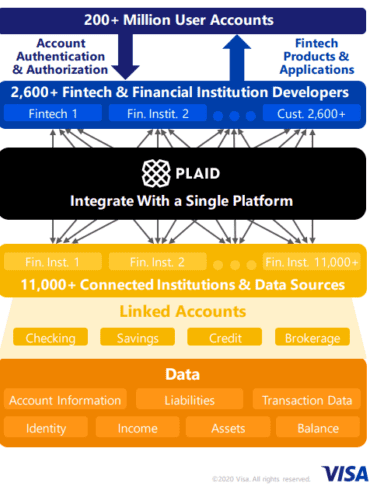

I dig deeply into the $5.3 billion acquisition of data aggregator Plaid by $500 billion payments network Visa. We examine why this deal is worth 25-50x revenue, while Yodlee's sale to Envestnet was priced much lower. We also look at how Plaid could be an existential threat to Visa, and why paying 1% of marketcap to protect 200 million accounts may be a good bet. Broader implications for product manufacturers across payments, investments, and banking also emerge -- the middle is getting carved out, and infrastructure providers like Visa or BlackRock are moving closer to the consumer.

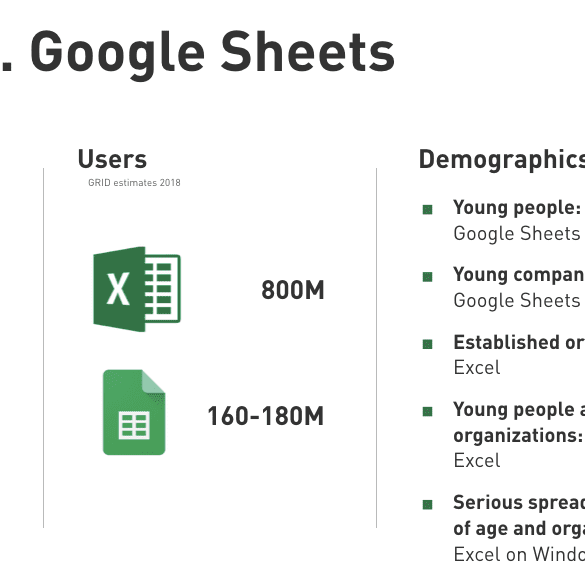

At $13 billion of revenue and 800 million users in 2016, Office 365 roughly generated $20 per user. That's like Monzo, but with the user foot print of Ant Financial.

You might think the comparison is daft. But let's dig a bit deeper. Excel, and spreadsheets more generally, are the default behavior for managing personal finances. Even for financial advisors, who are supposed to be the precise niche leveraging financial planning software, Excel is the default "do nothing" option. If you are not paying for digital wealth software as an advisor, you are doing it in Excel.

Alibaba’s Alipay was granted an eMoney license in Luxembourg to allow the company to serve customers across Europe; the eMoney...

Former FDIC Chair Sheila Bair writes in the FT that in light of the recent hack to Equifax should regulators be providing more entry points to customer data; she goes on to explain past bank hacks are typically done using a third party who has gained access to a customer’s data; other key points include can these service providers cover potential losses and are regulators forcing service providers into the most secure process. Source.

Despite the fact a recent study suggests only 22% of those in the UK had even heard of “open banking”...

In the "Top 10 Disruptive Technologies in Fintech" report, Juniper identifies the emerging technologies that are disrupting and influencing financial services in 2017; the top three include PSD2 and open APIs, regtech, and chatbots; at the top of the list, open APIs are a trend influencing financial services globally and Europe's PSD2 legislation is expected to help accelerate innovation. Source

Mastercard said all consumers will be able to use biometric identification when they shop and pay by April of next year; banks offering Mastercard branded cards will have to have biometrics alongside the typical PIN and password; the company cited consumers preference for this type of authentication and new regulations like PSD2 in Europe; Mark Barnett, president, Mastercard UK and Ireland, tells Banking Technology: “It will make the purchase much smoother, and instead of having to remember passwords to authenticate, shoppers will have the chance to use a fingerprint or a picture of themselves.” Source.