In this week’s WeiyangX Fintech Review reported by Crowdfund Insider they cover the rumors that the CBRC suspended online lending by private banks; private banks were only permitted to be in operation for the last 3 years and this news is reported to be done because of concerns over stability at the banks; a charity crowdfunding platform, Fenbeichou, was accused of fraud; the PBOC released new rules for mobile payment security including all QR code providers now need a permit. Source.

Some of biggest bitcoin miners in China have reportedly been looking to set up operations in other Asian countries; there has been conflicting reports out of China is the last week as to what the country is doing when it comes to mining operations; the PBOC has not made official comments yet and the mining overall doesn’t look to slow down as other countries can fill the role of China. Source.

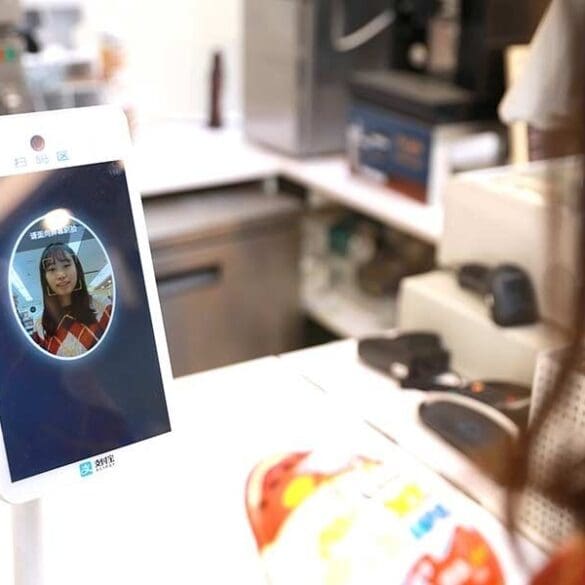

Mobile payments in China have taken off in recent years as Ant Financial and Tencent dominate the market; in recent...

Mastercard has gained approval from the People’s Bank of China (PBoC) to enter the Chinese market as a bank card...

The People’s Bank of China has recently launched a trial version of their digital currency which they hope will reduce...

As CoinDesk reports Chinese publication Caixin said that the PBOC did not hold a meeting on shutting down mining activities; the meeting was supposed to be held on January 3rd and meant to focus on banning mining; the news means that the Chinese government is taking a more agnostic approach to bitcoin mining, not endorsing it but at the same time not banning it; more concrete news should surface in the coming months, for now firms like Bixin and ViaBTC will keep operating. Source.

Bitcoin Exchanges Try to Lure High-Speed Traders like Virtu and Citadel Zopa to boost regulatory clout ahead of Brexit PBoC...

Fighting Chinese Artificial Intelligence with lasers and American Crypto with European Central Banks

How do the Americans and the Chinese have such different ethical takes on privacy, self-sovereignty, media, and the role of government? We can trace the root cause to the DNA of the macro-organism in which individuals reside, itself built over centuries and millenia from the collective scar tissue of local human experience. But there is more to observe. The technology now being deployed in each jurisdiction -- like social credit, surveillance artificial intelligence, monitored payment rails, and central bank cryptocurrency -- will drive a software architecture into the core of our societies that reflects the current moment. And it will be nearly impossible to change! This is why *how* we democratize access to financial services matters. We must be careful about the form, because we will be stuck with it like Americans are stuck with the core banking systems from the 1970s. But the worry is not inefficiency, it is programmed social strata.

According to more than 80 patents viewed by the Financial Times the People’s Bank of China has made significant progress...

No More Content