ZestFinance, the pioneering artificial intelligence software company focused on credit, has launched a new tool called ZAML Fair that aims to...

Personal credit and financial management firm Credit Sesame raised $42mn in equity and venture debt; investors include Menlo Ventures, Inventus Capital, Globespan Capital, IA Capital and SF Capital; the capital will be used for growth, hiring, customer acquisition and to build out their machine learning technologies. Source.

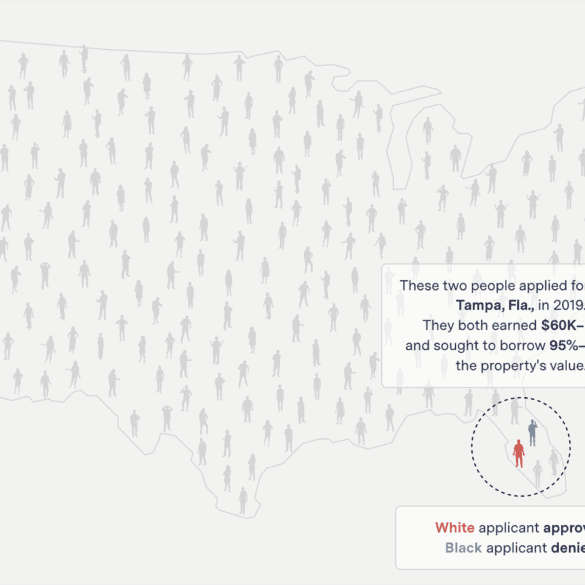

Bias in credit underwriting is an issue some worry will be exacerbated by AI others believe it is the only way forward. At Fintech Nexus USA 2022, approaches were discussed to mitigate concerns.

Everyone is talking about how AI is the next big thing, and there is no doubt it is making waves. But is the world ready?

Auto lenders are not yet ready to turn credit decisions over to artificial intelligence and machine learning; Mike Kane, Ally Financial...

I first wrote about Peerform way back in 2010 when they began life as Lendfolio. Even though they are not...

·

If a financial institution looks beyond the hype of AI and tempers its expectations, it can use AI to deliver measurable business results. That’s been the experience of Amount’s director of decision science Garrett Laird.

With AI and machine learning technology becoming better banks of all sizes have started to employ chatbots with more regularity; Crowdfund Insider takes a look at 5 banks employing the technology; banks include Bank of America’s Erica, Swedbank’s Nina, Capital One’s Eno, SEB’s Aida and Wells Fargo; in most cases the chatbots help with simple tasks like checking balances, paying bills and finding the closest ATM. Source.

Nav announced a partnership with Marcus by Goldman Sachs to offer SMB owners lines of credit through machine learning on the platform.

BlackRock, the world’s largest investment group, is setting up an AI research lab; the move is part of a wider industry trend by asset managers to use AI and machine learning for investments; the lab is meant to help their current teams and clients better understand how best to utilize the new technologies; “Big data offers a world of possibilities for generating alpha [market beating returns] but traditional techniques are not good enough to analyse the huge volumes of information involved,” said David Wright, head of product strategy in Europe for BlackRock’s scientific active equity division, to the FT. Source.