[Editor’s note: This is a guest post from Sasha Orloff. He co-founded LendUp and Mission Lane and previously was Senior Vice...

LendUp has long been a champion of the non-prime consumer, what is known as the emerging middle class. They have...

LendUp has secured a new $100 million credit facility from Victory Park Capital bringing its total financing to $325 million; the firm has also announced a new lending milestone, with loan originations surpassing $1 billion from more than 3.3 million loans; the firm was launched in 2012 and seeks to support the emerging middle class through lending and financial education. Source

LendUp is a company focused on providing access to credit for the underserved; with the news announced today LendUp will...

LendUp aims to improve the financial health of their customers through various products and initiatives; the interview covers a wide variety of topics including the subprime customer in the US, who they lend to today, their 2018 plans, their proprietary technology and more. Source

The CEO of LendUp talks about short term lending and the changes she has made in her first year as...

LendUp shared today that they had crossed $2 billion in consumer loans; since first beginning in 2012 they have provided...

One of the companies the LendIt Fintech team has always held in high regard is LendUp. They are tackling a...

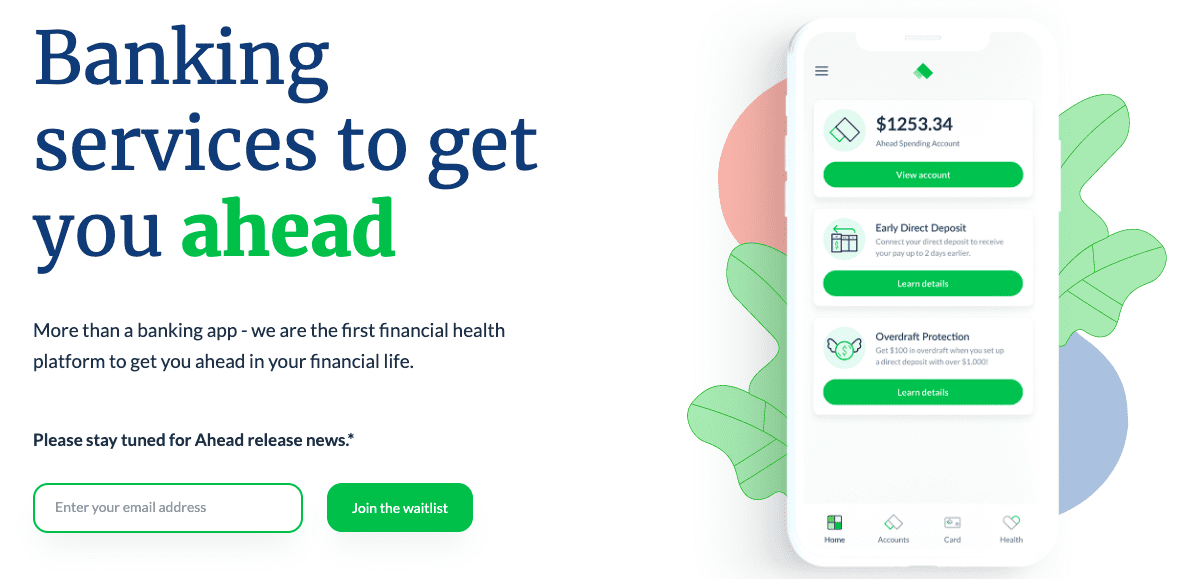

Consumer demographics are changing with more volatile income, and less interest and access to traditional banking products; LendUp has been working to provide a broader array of solutions for an underserved demographic of consumers and the fintech company has reported a number of successes; it has originated over $1 billion from more than 3.3 million loans; success for the company has come from offering innovative and diverse solutions paired with educational support; examples include graduated credit products that help customers migrate from a $250 emergency loan to a $1,000 installment loan to a $300-$500 low-balance credit card; the firm has integrated initiatives that improve credit availability for on time payments and credit management classes, also reporting $55 million in savings for customers. Source

Alternative credit underwriting and new data solutions for broadening credit underwriting have been emerging themes in recent quarters; the Consumer Financial Protection Bureau is currently researching alternative data underwriting and many fintech companies are developing new solutions for broadening credit availability and reaching more thin file borrowers; Sasha Orloff from LendUp discusses some of the important factors for consideration in broadening credit availability in his presentation at LendIt USA 2016 highlighting some of the initiatives that are currently developing in today's market. Source