A few weeks ago Jeff Rose, a fellow blogger and certified financial planner was asked to give a speech at...

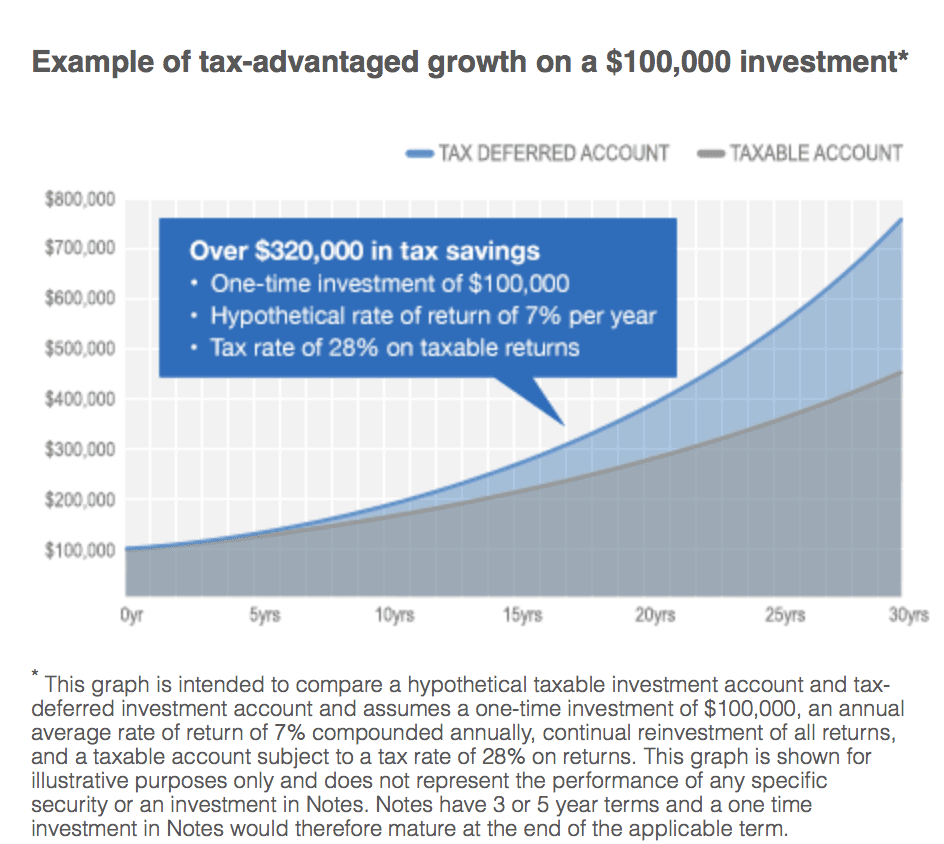

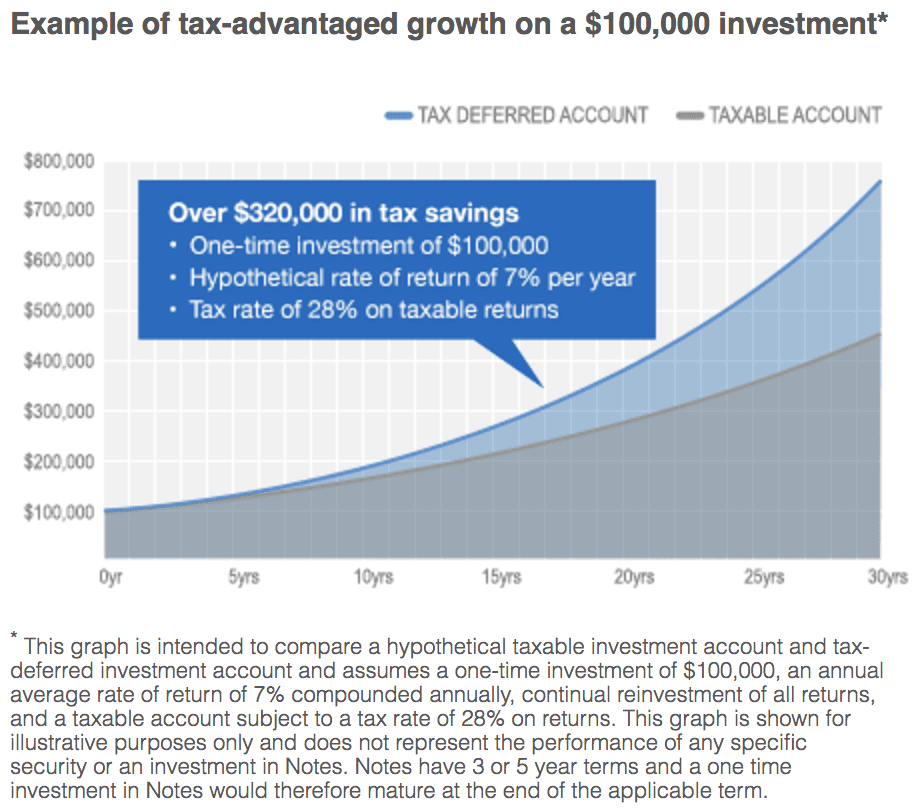

Taking advantage of tax deferred earnings is extremely important in building wealth for retirement. The tax savings over the course of...

I have mentioned before that I am a big fan of the Lending Club IRA. I rolled over all of...

[Update: This post is now irrelevant because Prosper started offering an IRA in 2012. Prior to this you had to...

The April 18, 2017 tax deadline also marks your last chance to fund a new traditional IRA or Roth IRA for 2016. Both...

Today, I am going to open the kimono, so to speak, and provide an inside look at all six of...

As 2010 winds down it is always good to think about your tax situation. You might be very pleased with...

We often discuss the benefits of investing in p2p lending in a tax advantaged account, but we haven’t covered the...

Now that tax season is behind us many of us will be wondering what to do with our tax refunds....

Lending Club and Prosper allow for tax efficient investing on their platforms through an IRA; Lend Academy provides details on opening an IRA with Lending Club or Prosper and explains why investing in P2P lending is best done through an IRA. Source