Voice recognition and machine learning technology are combining to offer consumers new services across various industries; in financial services ING has invested $945 million in a digital technology initiative that plans to include voice automated banking services through devices such as Amazon Alexa and Google Home; Amazon Alexa is now working with many financial services clients for voice integration including UBS, LPL, Fidelity, Capital One and Betterment; this week it was also reported that Wal-Mart will partner with Google to offer customers voice directed ordering through Google Home on Google Express. Source

Google Play has created a guide for developers focused on fintech financial health apps; the guide was created in partnership with the Center for Financial Services Innovation and specifically its Financial Solutions Lab; the guide provides best practices for developing financial health focused apps for Android and distributing them through Google Play; Google Play is also featuring a page with financial health apps. Source

The big question in fintech for the last few years is what will happen when firms like Facebook, Google, Amazon...

Dodd-Frank requires banks to disclose information about employee wages and the data shows a mixed bag for banks; banks like Goldman Sachs lie on the high end of the pay scale while small banks in locations like Houston are at the bottom of the spectrum; what the data also shows is banks are finding it hard to compete with big tech firms for talent as companies like Google, Facebook and Amazon tend to pay premium wages; wages overall look to be rising as lower skill, lower wage jobs are becoming less frequent across the industry. Source.

Normally, I include all p2p lending news stories in my weekly Saturday roundup. Occasionally, though, I feature the major stories...

Federal banking regulators issued a cloud security reminder as most banks have shifted their employees to work from home mode;...

Open banking and data aggregation have quickly become two of the biggest trends in financial services; Europe and UK regulators...

Since the financial crises banks, for the most part, have focused their time and effort on complying with new regulations and building up capital ratios in case another crisis hits; while they were doing this another industry, fintech, emerged and has eaten into some of the core profit making businesses of the banks; banks have started to catch up with technology and as countries like the US look to pare back some crisis era rules the banks see the next few years as the perfect opportunity to invest wisely in technology; the one thing the banks might not be able to handle is if Amazon, Facebook or Google begin to encroach further into fintech, potentially bring in competition who can immediately match up in size and strength. Source.

Finance is everywhere, and everywhere is finance. Smart city supply chains, self driving car insurance, video game real estate markets -- no matter which frontier technology you touch, it will have embedded implications on the delivery of financial services. And why wouldn't it? Like the use of language, finance is a human technology that allows societies to coalesce and compete with one another (in the Yuval Harari sense). It lifts people out of poverty and into entrepreneurship through microloans, providing generational sustenance for their families. And of course it also throws them into pits of corruption and greed, as they drink too deeply from the rivers of securitization and political power.

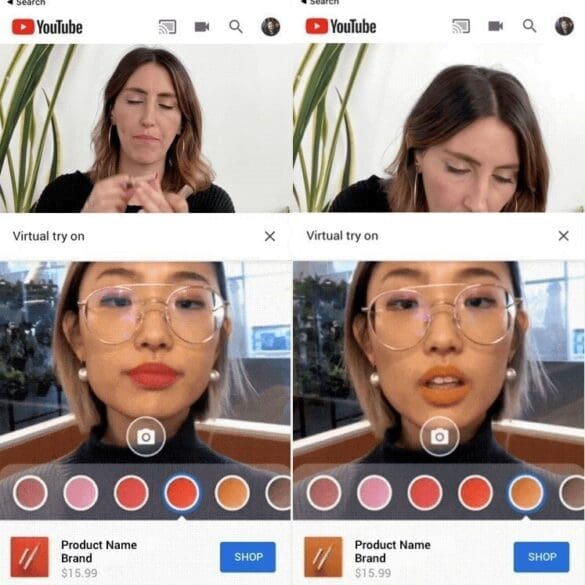

But enough poetry! I want to talk about augmented reality, attention platforms, and the re-formulation of payments and lending propositions in a global context.

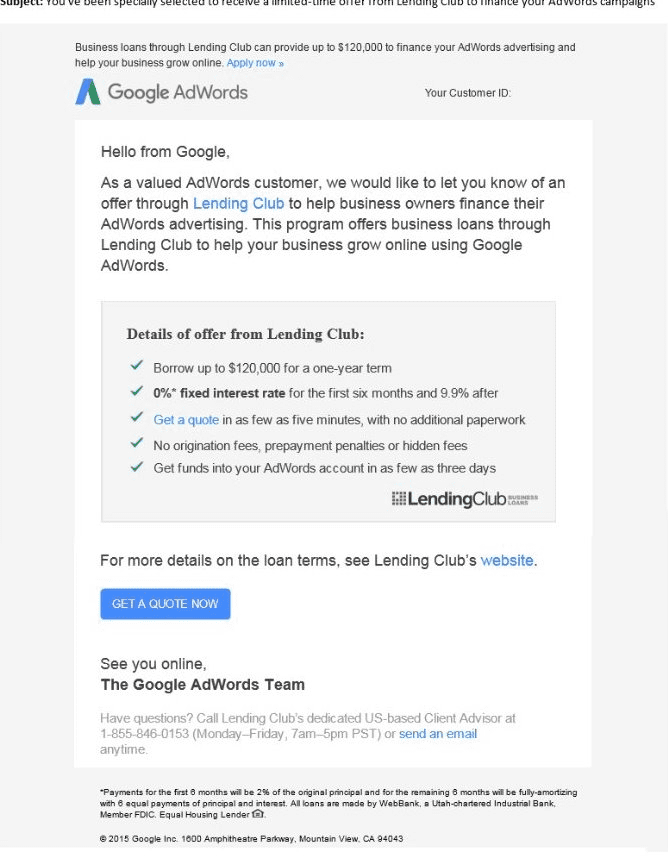

Lending Club, who have been offering small business loans for more than 18 months, is now targeting small businesses in a different...