Making fintech news this week is Coinbase, Stripe, Goldman Sachs, Column, Robinhood, FTX and more.

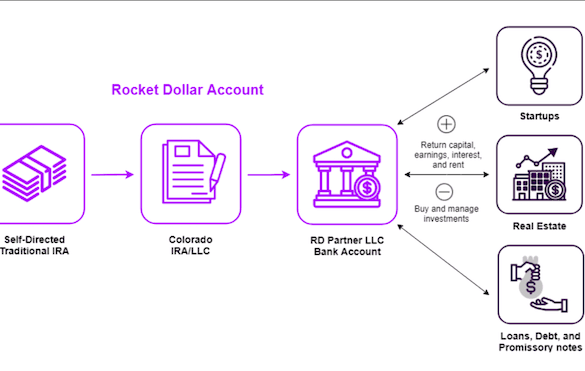

In this conversation, we chat with Henry Yoshida – Co-Founder & Chief Executive Officer, Rocket Dollar. Prior to Rocket Dollar, Yoshida was the co-founder of Honest Dollar, a robo-advisor retirement platform that was acquired by Goldman Sachs, as well as a founder of MY Group LLC, a $2.5-billion assets under management investment firm. Henry shares his industry expertise as a speaker at several industry conferences, as well as having been featured or quoted in the Wall Street Journal, TechCrunch, Bloomberg Businessweek, and Financial Times. Henry has a passion for helping people be the best that they can be and contributes as a member in several financial and technology industry organizations. He graduated from The University of Texas at Austin and has an MBA from Cornell University.

More specifically, we touch on Henry’s career at BoA Merrill Lynch, his role at building a multi-billion dollar RIA business, how he started a digital retirement account platform called Honest Dollar which was sold to Goldman Sach’s neobank Marcus, the inception of Rocket Dollar, we talk IRAs and 401ks and how important these are for the current Gen-Z market, and so so much more!

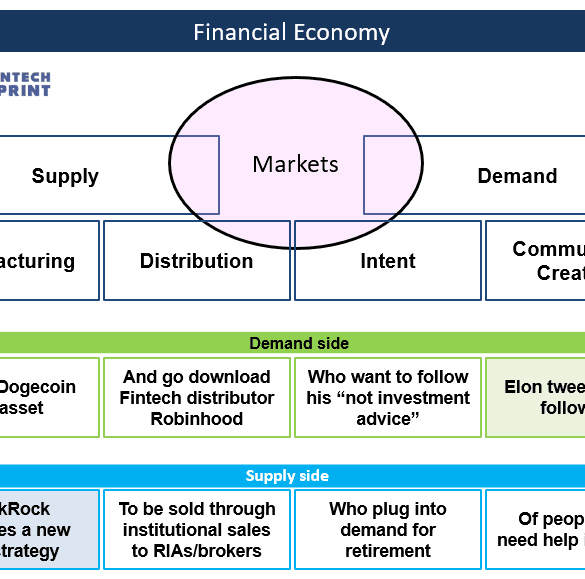

Square upgrades Cash App into a payment processing powerhouse, completing the loop between the consumer and merchant side of the house. Goldman Sachs acquires GreenSky, adding a lending business at the point of intent. This analysis connects these symptoms into a framework explaining the increasing integration between commerce and finance, and the increasing role that demand generation plays. That in turn explains how the attention and creator economies interconnect with financial services.

Last year will be known for a myriad of events. While the institutionalization of crypto might not make it to...

Even though it does have a lending operation Amazon did not take part in the Paycheck Protection Program directly; but...

In 2021, firms who had stayed alive through the initial pandemic became giants: fintechs became banks, banks became super apps, and super apps became some of the most successful public companies in the world.

digital transformationEmbedded Financeenterprise blockchainexchanges / cap mktsmega banksneobankOpen Bankingopen source

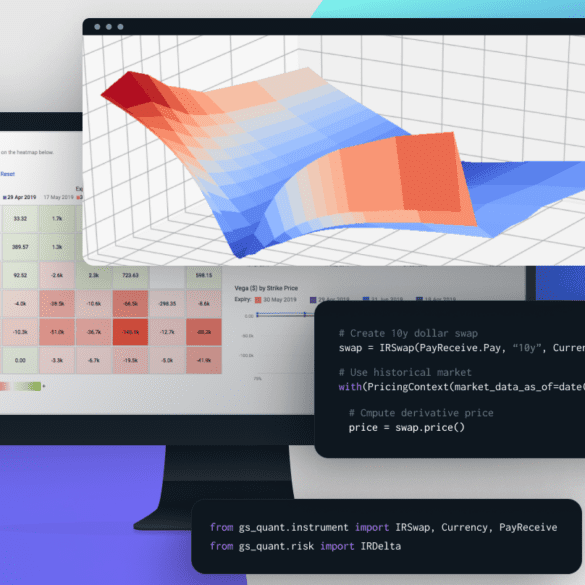

·In this analysis, we focus on Goldman Sachs launching an institutional embedded finance offering within Amazon Web Services, and Thought Machine raising a unicorn round for its cloud core banking platform. We explore these developments by focusing on the emerging role of cloud providers as distributors of third party software, think through some of the implications on standalone fintechs and open banking, and check in on AI company Kensho. Last, we highlight the difference between Web3 and Web3 approaches to “cloud”, and suggest a path as to how those can be rationalized in the future.

Wednesday morning Goldman Sachs, not looking to be left behind, announced it would be acquiring GreenSky for $2.24 billion.

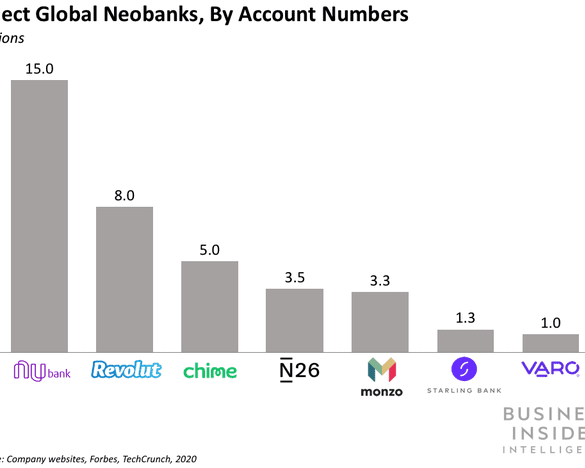

In this conversation, we break down recently published annual reports from Revolut, Starling and Monzo, three of the leading European digital banks. There are some fascinating insights to be drawn from the documents, especially in the context of the broader global fintech market. This is rich subject matter, and we surely didn’t cover everything.

Goldman Sachs is looking for inspiration from the big tech companies rather than big banks as it considers where to...