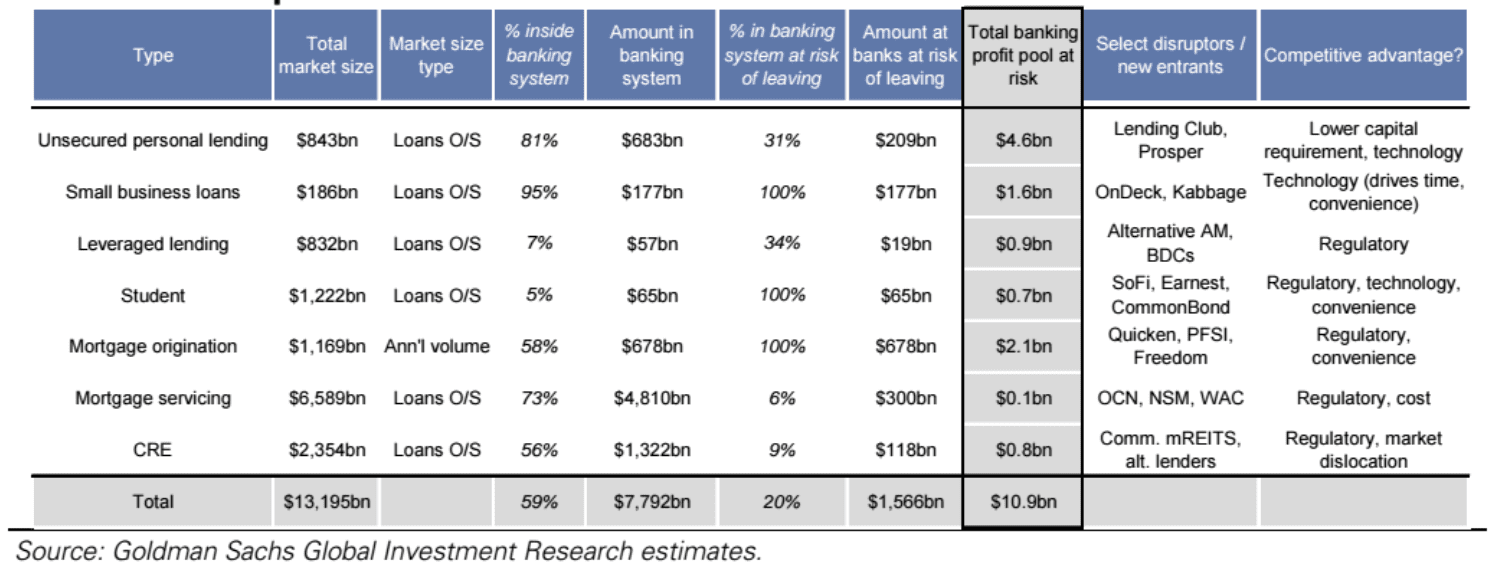

The addressable market for marketplace lenders is massive. The one trillion dollar figure has been thrown out as the market...

As we reported in June of this year, we will likely see Goldman Sachs enter the online lending market with their new platform next...

According to the New York Times the long awaited online lending platform from Goldman Sachs now has a name: Marcus....

Goldman Sachs and Santander have announced they are leaving the R3 Blockchain Consortium; Goldman Sachs was one of the 12 founding members of the Consortium; the reasoning behind the move is unknown however speculators believe it is likely due to solicitation of $150 million from members. Source

Online lending platform Marcus by Goldman Sachs is now open to all borrowers; the bank launched its lending platform in October 2016 for borrowers receiving an email code; like other marketplace lending platforms it offers low borrower interest rates; one of its leading advantages is that it offers no fees; Goldman Sachs will announce its fourth quarter earnings in January with insight expected on the new platform's business. Source

Goldman Sachs is entering P2P lending. This is a major milestone for our industry since it marks the 1st bank...

At the end of every year I like to look back at the biggest stories that made news in the...

The long awaited consumer lending platform from Goldman Sachs, called Marcus, has launched today. We have written about the Goldman...

Many of us in this industry will be glad to see the last of 2016. It has been a difficult...

Goldman considers Marcus a fintech startup supported by 147 years of experience from the global investment bank which has given it some advantages in the online lending market; the fintech startup and its use of application programming interfaces (APIs) has been part of some important digital innovation initiatives for the firm; according to Chavez, Goldman is not only exploiting APIs, but open source and cloud services as well; he refers to the integration of the three services as the most "profound drivers" of innovation in financial services he's ever experienced; Goldman has integrated APIs into nearly all aspects of its business and API-centric technology is a key factor for innovation in the global fintech market. Source