Fraud is rising, and with real-time payments taking an ever greater hold of the financial system, faster ways to combat are needed.

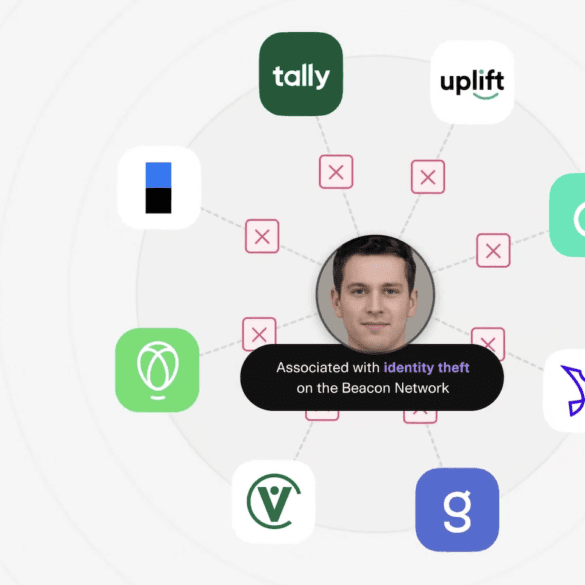

ID Analytics introduced the Online Lending Network in October 2016 with the goal of providing greater resources to lenders for mitigating fraud; Online Lending Network members access internetwork supplied data and information from ID Analytics for greater detection of fraudulent loan applications and loan stacking; ID Analytics reports that the network has achieved visibility into 75% of US domestic marketplace lending activity since inception with membership increasing by 50% since its launch. Source

Real-time payments systems have globally increased the threat of related fraud. Will FedNow follow the trend?

'The real power is that AI can actually predict or detect patterns of behavior and suspicious activity that would take a lot longer for traditional methods to uncover.'

In this episode we talk with the CEO and Co-Founder of Sardine, Soups Ranjan, about fraud prevention. He discusses the trends in fraud attacks today and how fintechs can prepare themselves in their battle with fraudsters.

The service from Whitepages Pro can add another layer to identity verification for online lenders; it provides lenders with analysis of a potential borrower's associated phone number, email, mailing address and business name; Whitepages CEO Rob Eleveld says the service gives lenders a broad profile of the borrower which in most cases is difficult to fraudulently create; it can also be accessed through APIs which makes connecting to the service easy for lenders. Source

In an era where digital fraud is on the rise, trust becomes the cornerstone of customer relationships. Learn how to enhance customer experience without sacrificing security in this new white paper.

American Banker discusses the evolution of online lending fraud and the industry's vulnerabilities; the combination of synthetic identities and multiple loan inquiries known as loan stacking have increasingly become a threat in the industry; while a number of new systems have been implemented to mitigate fraud the nature of the business makes it more susceptible with fraud prevention solutions becoming more prevalent. Source

Sardine, a leader in the fraud prevention and compliance space has upped its game against widespread fraud.

SoFi said it missed their internal 4th quarter earnings projections due to lower than expected loan performance, increased hiring costs and expenses related to management changes according to the WSJ; the company also said they expect the loan performance trend to continue into 2018 as the look to refine their credit model; the company is also looking to improve fraud prevention, automate loan processing and get better at collections. Source.