As the crypto market continues to fall big tech companies like Facebook are taking the opportunity to hire talent from...

The news that Facebook is building their own cryptocurrency has regulators nervous on many fronts including money laundering and know...

New reports surfaced in the New York Times about Facebook’s secret plans in the cryptocurrency space; the company is building...

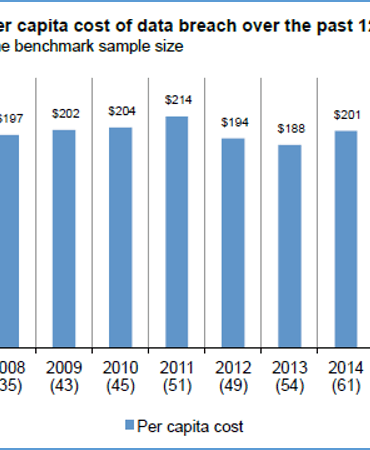

Capital One recently suffered a data breach resulting from poor security practices that exposed 100 million credit card applications and accounts. They expect the breach to cost the company $150 million. Two years back, Equifax lost 140 million identities, again from poor security practices. At the time, I said that according to GDPR this should cost them $150 million. They have since settled for about $600 million -- though some of that seems to be in-kind services coverage like free credit monitoring (lol!). Separately, Facebook has settled for a $5 billion fine associated with the Cambridge Analytica privacy "breach".

While regulators in the U.S. and around the world had mainly negative things to say about Facebook’s new Libra digital...

Facebook along with their partners are contemplating a redesign of Libra; the changes could include the network accepting multiple coins,...

Coindesk has dug into the Libra white paper which references how they might address digital identities: “An additional goal of...

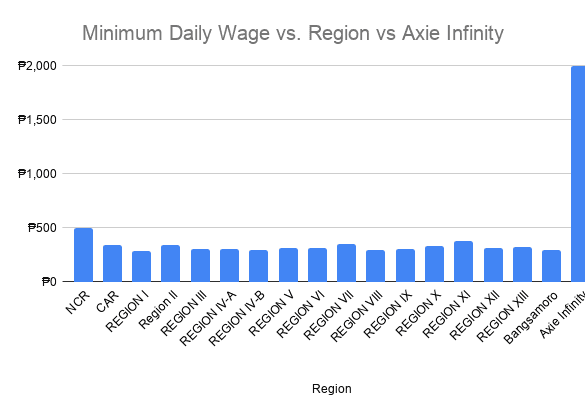

Facebook is building towards a Metaverse version of the Internet, in both its hardware and software efforts. What are the implications? And further, how does one acquire status, work, and social capital in such a world? We explore the recent NFT avatar projects through the lens of Ivy League universities and CFA exams to understand some timeless cultural trends.

Facebook is launching a WhatsApp-based digital payments service for the messaging app’s 120m Brazilian users; users will be able to...

Ireland has become a hub of technological innovation as big tech, fintech and big financial services companies set up shop in country as an alternative to the UK; “Ireland has always been quite an innovative country; it has to be because it is such a small market, you can’t just lean on the Irish market to produce a decent fintech business.” says Sinead Fitzmaurice, co-founder of TransferMate, to the FT; talent from Google and Facebook have not only started their own companies but have also moved into finance giants like Deutsche Bank; low corporate tax rates combined with the tech talent has help the country become an emerging fintech market. Source.