Upstart's Q4 earnings showed a downward trend of losses, CEO, Girouard, remains positive despite cost cutting measures.

LendingClub saw revenue and earnings at the high end of their guidance range but, due to ongoing uncertainty remain reserved with next steps.

Nubank's shares ticked 4% higher on market opening following a surge in profits during the fourth quarter of 2022.

LendingClub reported Q1 2024 earnings and the company exceeded analyst expectations for both revenue and profit.

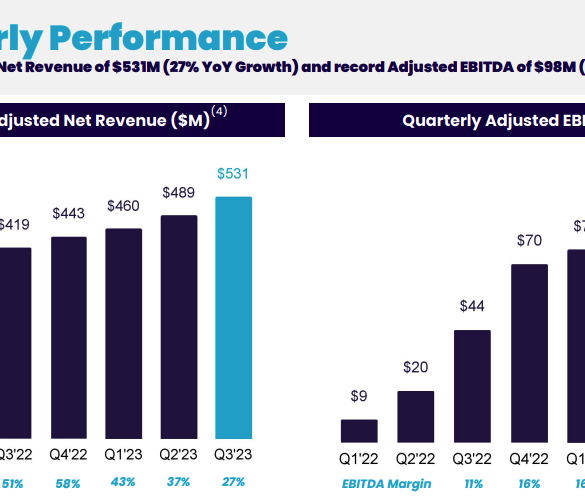

SoFi reported their financial results for Q3 2023 and showed considerable improvements across all areas of their business.

Creditas aims to reach breakeven in 2023. It has reduced losses for five straight quarters and is repricing the portfolio with higher rates.

Mercado Libre booked $359 million in profits from $129 million a year ago, driven by strong e-commerce in Mexico and growing fintech products.

PayPal's upbeat earnings call came with the announcement of Schulman's departure and prudent guidance for 2023.

Marqeta reported solid earnings for the third quarter of 2023 showing significant growth in card processing volume and reduced losses.

Upstart reported Q4 2023 earnings yesterday with $140m in revenue for the quarter and a loss of $47.5m.