Making news this week was Chime, Generative AI and Ocrolus, ChatGPT, JPMorgan Chase, the CFPB, the OCC, PayPal,the European Central Bank, Stripe and more.

Chime has come a long way since its founding a decade ago, but co-founder Chris Britt said the company is only getting started.

Many of these firms have aimed to go public in the vague "end of 2021/ early 2022/ when we have enough money" time frame while participating in increasingly rare-letter funding rounds.

This week, we look at:

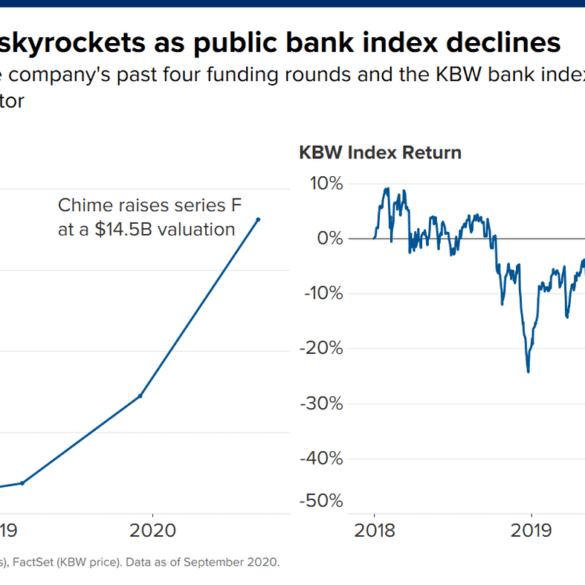

Chime, eToro, and Wise targeting the public markets through IPO and SPACs, and their operating performance

The overall growth in fintech mobile apps, their install rates and market penetration (from 2.5 to 3.5 per person), and whether that growth is sustainable

The implications for incumbents from this competition, and in particular the impact on money in motion vs. money at rest

Broader financial product penetration and an anchoring in how the technology industry was able to get more attention that we had to give

According to a new survey by Cornerstone Advisors 6 percent of U.S. adults with a checking account consider a digital...

There was a spate of negative fintech news this week. We had significant layoffs from two of the largest fintechs in the country, Stripe and Chime and Coinbase reported miserable Q3 results.

LendIt Fintech confirmed the opening speaker at their USA event May 25-26 at the Javitz Center is Chris Britt, Founder, and CEO of Chime.

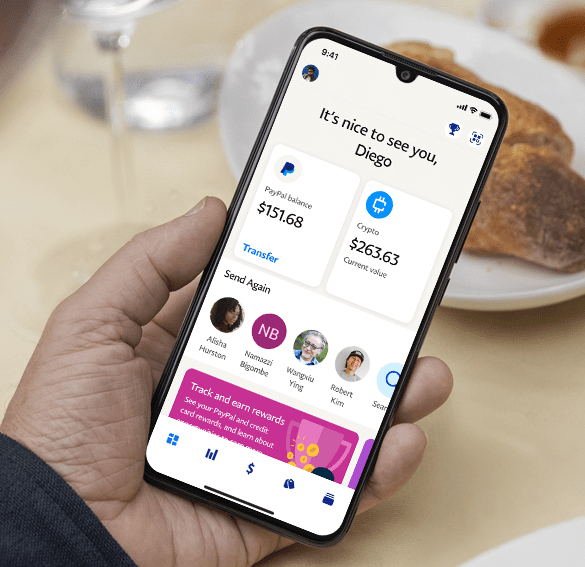

PayPal just launched what it calls a super app. It has a cash account with a 0.40% interest rate, direct deposit, money movement, bill pay, and remittance features. It also integrates shopping functionality with rewards and cash back. In this analysis, we compare this offering with Google Pay and Square Cash App, as well as trace the DNA of PayPal to understand whether such an offering will succeed where others failed.

This week, we look at:

PwC estimating that $900 billion has been wasted on digital transformation projects for enterprise, meaning finance is vulnerable

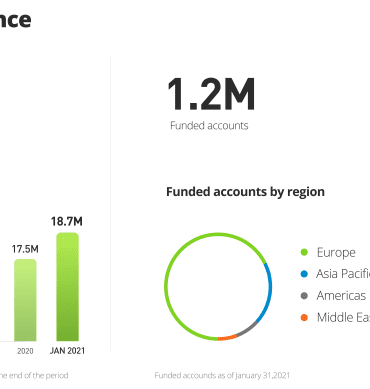

Chime is worth $15 billion in the latest round of valuation, same as $200B+ depository bank Fifth Third, which is quite the achievement

Decentralized exchange Uniswap distributing 60% of its token to the community, flipping the ownership and value accrual model

As a thought experiment -- today, if you want to save for a house, you may create a financial plan in Betterment and wait for the portfolio to accrue. Tomorrow, you may bring cashflows to a housing protocol which intermediates property markets, and build your portfolio directly into your desired goal of buying a house. Your stated selection and articulation of that goal, by choosing the housing protocol, generates value on its own through rewards, participation, governance, and various interest rate products.

The current pandemic has shaken our world in ways most of us could not even imagine and fintech companies have...