It was only a month ago that we covered Yieldstreet’s partnership with Citi, allowing YieldStreet investors to have access to...

It has been almost four weeks since LendingClub closed down its retail investor platform and cash is already starting to...

I started investing on Yieldstreet about a year ago because I liked the unique investment offerings the company had. I...

The President and Co-Founder of Yieldstreet, Michael Weisz, joins Zack Miller on the Tearsheet podcast to discuss digital wealth management...

The marketplace lending industry has never had to deal with an environment where interest rates are increasing. We’re not talking...

The list of the Americas’ fastest growing companies highlights 500 businesses and was compiled with the research company Statista; it...

YieldStreet Co-Founder and CEO Milind Mehere knew what is was like to be shut out of investment opportunities; after successfully scaling and selling his previous business he started YieldStreet to provide real estate, litigation funding and more to a wider group of investors; the company has returned over $80mn of principal and interest to investors; seeing litigation funding as one of the more interesting parts of the portfolio is an opportunity they feel is unique and can help to set the company apart. Source.

There have been no shortage of bank partnerships in fintech, but this might be the most unique. Last week we...

YieldStreet has reached $100 million in lending in less than eight quarters; the firm markets returns of 8% to 20% with a peer-to-peer lending model that offers secured loans; investment minimums begin at $5,000 and the platform has a range of investors including accredited, high net worth, family offices, registered investment advisors and institutional investors. Source

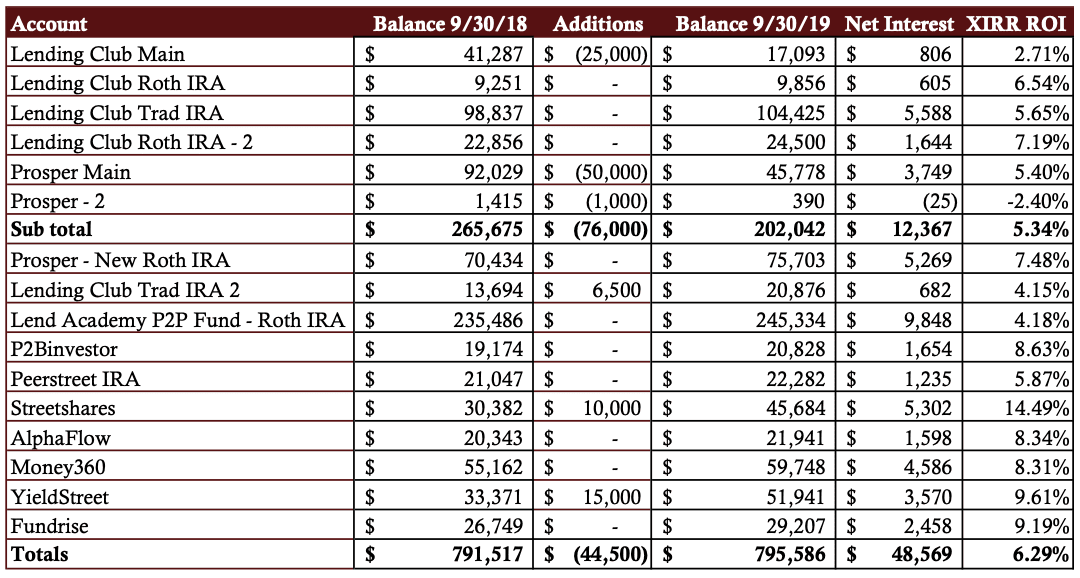

I am certainly late with this but I have finally found the time to bring you my quarterly returns report...