This week Isabelle spoke to FintelConnect's Nicky Senyard and Alana Levine, about the rise of Finfluencer marketing for fintechs.

This week Isabelle spoke to Extend's co-founder and CEO, Andrew Jamison about servicing the SME market despite increased economic challenges.

The biggest fintech show on the east coast is just one month away, Fintech Nexus USA 2023, and discounted pricing ends April 21.

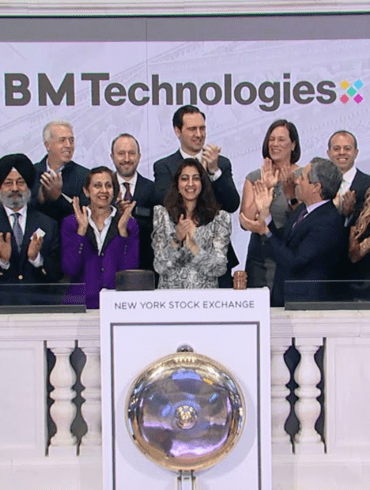

BM Technologies, a BaaS fintech that went public through a SPAC announced they plan to buy First Sound Bank, a community bank from Seattle.

The LendIt Rewind podcast has audio of all the sessions from LendIt Fintech USA 2018 conveniently published in a podcast...

This week Isabelle spoke to Pagaya's CIO, Ed Mallon about how lenders can still fulfill demand for credit despite challenges.

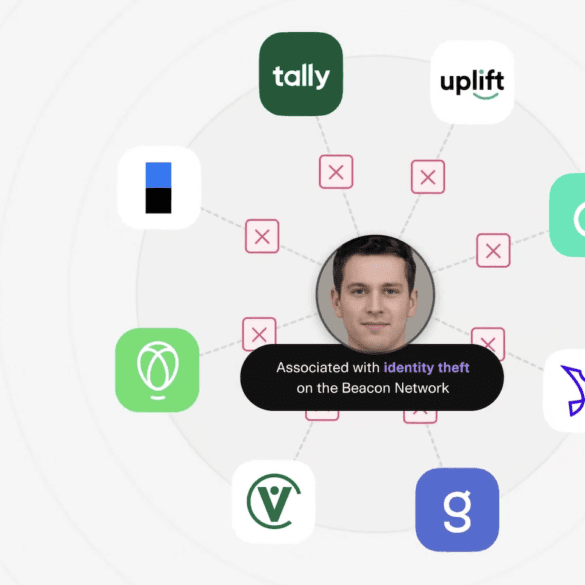

Fraud is rising, and with real-time payments taking an ever greater hold of the financial system, faster ways to combat are needed.

After more than a decade of conferences and content, fintech has evolved past online lending alternatives: Fintech Nexus brides the gap.

Yesterday morning, four fintech experts joined a Lendit panel to discuss Buy Now Pay later: how to lay the foundations for a successful BNPL offering.

Matt Hancock is the Secretary of State for Digital, Culture, Media and Sport and a Member of Parliament for West...