Stash opens the metrics kimono regarding growth during the pandemic How Sunrise Banks and Anvil onboarded $127M in PPP loans...

We are like the hungry at the all-you-can-eat buffet. In the beginning, there is not enough! Let's democratize access to food; to music; to transportation; to healthcare; to finance; to payments; to banking; to lending; to investing. The billions in institutional capital across universities, pensions, and sovereigns are delegated to smart portfolio managers. The day before yesterday, it was allocated by small cap stock pickers (hi Warren!). Yesterday, it was the alternative managers of hedge funds and private equity. Today, it is the trading machine and the venture capitalist. Tomorrow, it is the cryptographic artificial intelligence.

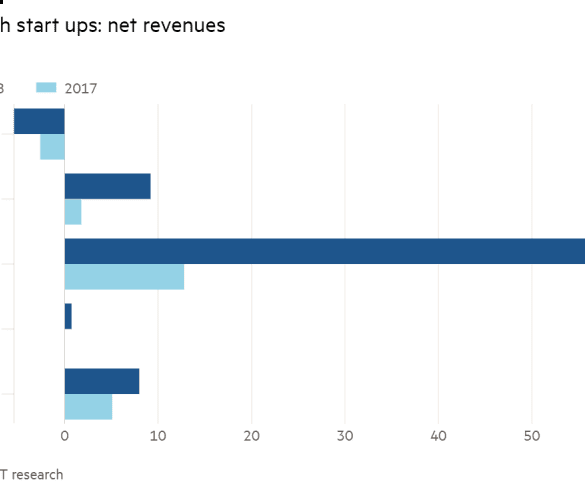

Digital banks have been presenting themselves as a more transparent fairer option than the traditional players; what these newcomers are finding is to scale and reach profitability they will need to figure out a way to lend that doesn’t strike the same tone as customers get from their typical bank; Tandem, Monzo, Starling Bank, Revolut and N26 have all started to roll out lending options in a variety of ways by using a tailored data driven approach; figuring out where the balance lies is the key piece if these banks are truly going to disrupt the banking system. Source.

Tandem is a banking app to help individuals manage their finances; according to the Financial Times, the acquisition will provide GBP80 million ($103.8 million) of capital as well as a banking license; Tandem lost their banking license earlier this year after a failed investment by a Chinese conglomerate; the firm was concerned about whether China's State Administration of Foreign Exchange would approve the transaction; the acquisition still has to go through regulatory approval but if approved will allow Tandem to offer savings accounts. Source

Tandem is set to begin a new monthly membership fee for their cash back card starting March 2020; the new...

The challenger bank has introduced a new savings account which has an Autosavings feature; it is a flexible account built...

Europe provides some interesting examples for fintech bank chartering and licensing as companies SoFi and Varo lead the way in the United States; two top companies to watch include Tandem and Klarna; fintech company Tandem recently acquired a bank, Harrods Bank, which will provide it with GBP80 million ($103 million) of capital and a banking license if the transaction is approved; Klarna has also been a fintech banking leader in Europe; the Swedish payments company recently received a banking license and has reported deals with Permira, Visa and Brightfolk. Source

In the midst of getting ready to launch in a few weeks the UK digital bank Tandem is now unable to launch with savings accounts; the bank was approved in 2015 for a banking license so long as they fulfilled a number of criteria including hiring a board, building out sufficient technology systems and raising enough capital to cover losses; the final point is where the bank was unable to comply, they fell short of raising enough capital and now are forced to launch without the savings feature; Tandem was expecting 29 million British pounds ($36.1 million) from House of Fraser, the UK department store chain that was bought by China's Sanpower Group, but Sanpower was worried about capital restrictions coming out of China so they pulled the funding. Source