As non bank lenders continue to gain market share across different loan segments, we wanted to give a complete overview...

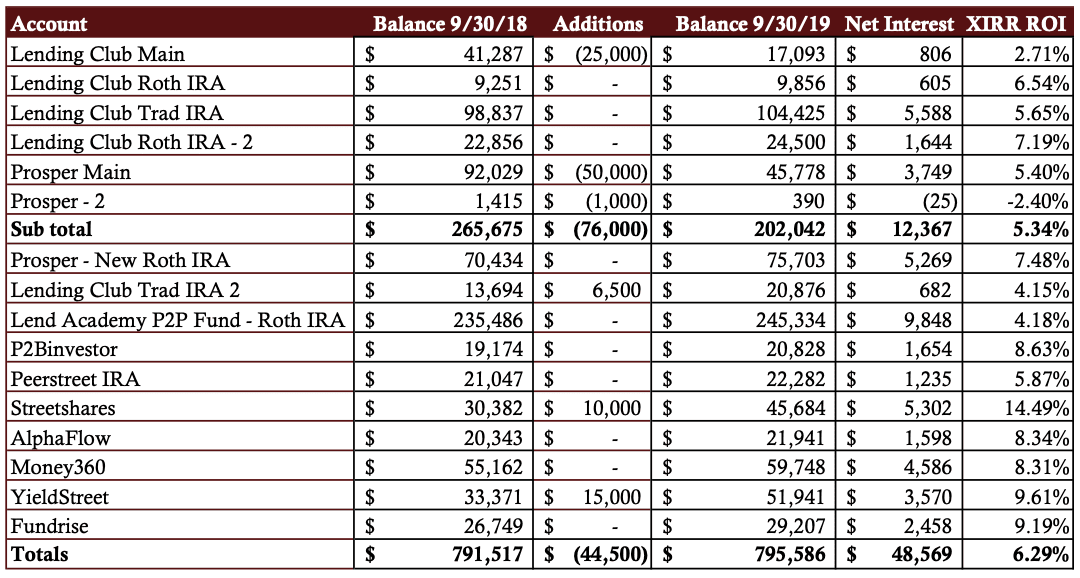

Every quarter Peter Renton, Founder of Lend Academy and Co-Founder of LendIt Fintech shares his investments in various marketplace lenders;...

Peter Renton, Founder of Lend Academy and Co-Founder of LendIt Fintech shares his marketplace lending portfolio performance for Q1 2018;...

Today StreetShares announced a $23 million Series B round; it was led by a $20 million investment from Rotunda Capital Partners, LLC; $3 million came from existing investors; StreetShares offers small business loans and primarily focuses on veteran-owned businesses. Source

StreetShares has announced a $10.3 million fundraising; the US marketplace lender specializes in funding business loans to companies managed by veterans; the platform has a range of product offerings with loans issued for $2,000 to $100,000. Source

StreetShares is a marketplace lender focused on lending and investing for veterans; company has announced partnership with JPMorgan to launch the StreetShares Foundation which will promote veteran-owned businesses through a $10,000 monthly contribution from JPMorgan for veteran small business awards; StreetShares will manage the monthly veteran small business awards with the $10,000 divided between first, second and third place businesses each month; awards will be given based on public voting. Source

I am certainly late with this but I have finally found the time to bring you my quarterly returns report...

Last month we learned that small business lender, StreetShares, closed on a $23 million Series B. This got us thinking....

StreetShares, who recently closed a Series A round today announced that they have received SEC approval to offer a product...

Fintech startup StreetShares, who lends to military veterans, plans to launch a new business credit card for the same community;...