In this week’s PeerIQ Industry Update they cover the continued growth in the jobs market with the unemployment rate dropping...

Kroll Bond Rating Agency has assigned preliminary ratings to a LendingClub securitization portfolio; the loan securitization, LendingClub Issuance Trust, Series 2016-NP2 (LCIT 2016-NP2), is valued at $101.75 million and includes two classes of notes with LendingClub consumer loans; the class A tranche which accounts for 84% of the deal at $85.3 million, is rated BBB; the class B tranche accounts for 16% at $16.4 million and is rated BB+. Source

Student loan marketplace lender, Earnest, has completed its fourth securitization; Goldman Sachs and Barclays were the lead arrangers; portfolio valued at $174.44 million; the October securitization is the fourth for the year with previous securitization deals in February, May and July. Source

Applied Blockchain has been trialling a system for companies to process their invoices on blockchain and in turn will allow the companies to tap the securitization markets; the current trial is with a UK SME called Emplas that makes windows; "Our platform may now allow for securitization of invoices as the underlying for bond issues," Ben-Ari, Founder of Applied Blockchain, tells Euromoney; "It brings transparency as to the ownership and establishes the provenance of invoices for bond buyers in ways that the existing processes and technology simply did not allow." Source

It was almost seven months ago when the news first came out about a massive deal that was in the works...

The Senior Managing Director at Kroll Bond Rating Agency discusses trends in marketplace lending securitization. Source

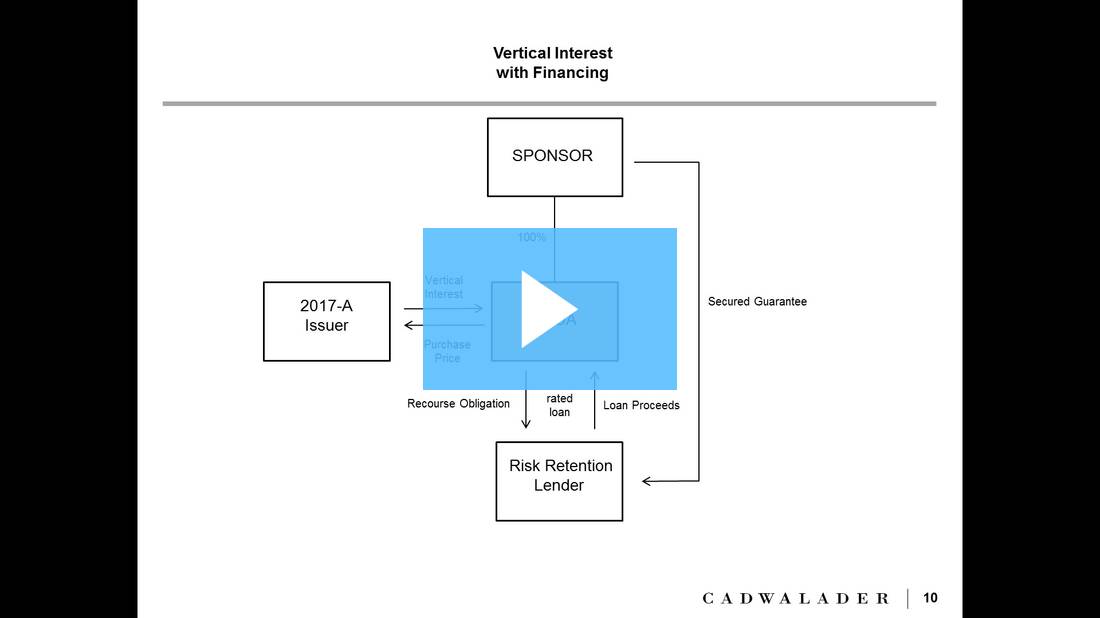

A replay is now available for LendIt's Key Considerations for Risk Retention in Securitization forum which was held on Wednesday, January 11, 2017; the webinar provided insight on new risk retention regulations for securitization in effect beginning December 24, 2016; speakers talked about a range of securitization related topics including optimal risk retention structures, commercial considerations related to sponsors and requirements necessary for majority owned affiliates.

The securitization includes £285 million of UK prime buy-to-let mortgage loans and was oversubscribed; Citi arranged the securitization who was...

Online mortgage lending has helped to revive the market for mortgage loan securitizations; new online mortgage lenders are providing a new wave of mortgage loan securitizations for the market specifically with fix and flips; these loans are attractive to investors because of the high yields and offer investors shorter duration investments because of the fix and flip focus; despite defaults and structuring inefficiencies created from the 2008 financial crisis, institutional investors are placing confidence in these investments; LendingHome has been leading the market with steady issuance of fix and flip loan securitizations and the products have been performing successfully for investors indicating the niche investments could begin to scale more broadly. Source

UK property lender, LendInvest, has completed a £285 million securitization of prime “buy-to-let” mortgages; it received a AAA rating for...