As real time payments have begun banks are finding it a challenge to implement them; how much should banks charge corporate clients for the service and how best to handle legacy infrastructure are two of the main questions they are grappling with; “Banks need to understand how they monetize these services,” Vinay Prabhakar, head of markets strategy for payments at Finastra, said to TearSheet. “Most banks have lucrative credit card programs, so how do they roll out RTP without cannibalizing their credit card models?”; Christopher Ward, PNC Bank’s head of treasury management product management, believes progress is being made and 90 percent of banks will have implemented real time payments by end of 2019. Source.

A study from WalletHub says 67 million Americans will not being able to pay their credit card bills due to...

Fintech savings app Digit launched an instant withdrawals feature with the help of JPMorgan Chase to allow users to move...

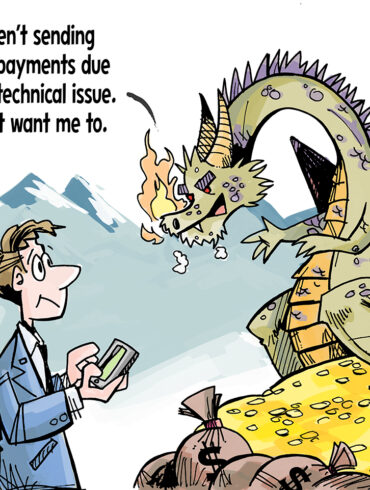

Banks are not rushing into real time payments, maybe they are looking to hoard their money?

The Federal Reserve said they will look to release the FedNow real-time payments system in stages starting in 2023 and...

BBVA Open Platform, a banking-as-a-service platform, allows their partners to build financial products through their APIs; they have now added...

The concept of embedded finance isn't new, but the modern form of the distribution model is emerging as a global payments force.

The banking as a service enforcement piñata

The original real-time payment method

FedNow's launch is imminent and there seems to be a whole lot of confusion about what it means - Here's all you need to know.